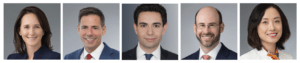

by Jarryd Anderson, Jessica S. Carey, John P. Carlin, Roberto J. Gonzalez, Brad S. Karp, and Kannon Shanmugam

Top Left to Right: Jarryd Anderson, Jessica Carey, and John Carlin. Bottom Left to Right: Roberto Gonzalez, Brad Karp, and Kannon Shanmugam. (photos courtesy of Paul Weiss)

On October 22, 2024, the Consumer Financial Protection Bureau (“CFPB” or “Bureau”) published a 594-page Notice of Final Rulemaking for its “Personal Financial Data Rights” rule, commonly known as the “Open Banking” rule, which will require covered entities—generally, providers of checking and prepaid accounts, credit cards, digital wallets, and other payment facilitators—to provide consumers and consumer-authorized third parties with access to consumers’ financial data free of charge.[1] Covered entities are required to comply with uniform standards to provide access to this financial data through consumer and developer interfaces.[2] The rule imposes requirements on authorized third parties (such as fintechs), as well as data aggregators that facilitate access to consumers’ data, including required disclosures to consumers regarding the third parties’ use and retention of the requested data and a requirement that the data only be used in a manner reasonably necessary to provide the requested product or service (thus foreclosing selling the data or using it for targeted advertising or cross selling purposes).[3]