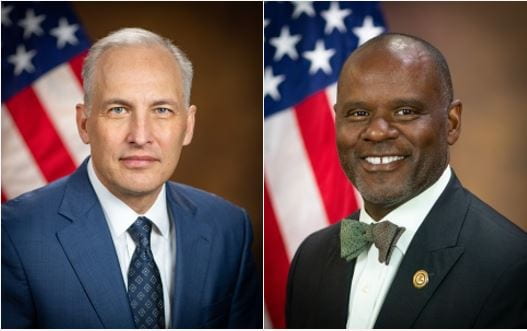

Matthew Olsen and Ismail Ramsey

We are honored to announce that Matthew Olsen, the Assistant Attorney General for the National Security Division at the U.S. Department of Justice, and Ismail Ramsey, the U.S. Attorney for the Northern District of California, will be additional keynote speakers at our 4th Annual Directors’ Academy at NYU School of Law on October 31st and November 1st, 2024. The agenda and registration portal are available here.

Olsen, who leads the DOJ’s mission to combat terrorism, espionage, cyber crime, and other threats to the national security, and Ramsey, who, as U.S. Attorney for Northern California, is colloquially known as the “Sheriff of Silicon Valley,” overseeing investigations and cases concerning the leading technology companies in the world, will participate in a keynote and fireside chat titled New and Persistent Cyber Threats Overlooked by Boards and Management: Lessons for Boards. The session, which will take place on October 31st, will focus on providing board directors and senior management with the information they need to identify and manage the most critical cyber and national security-related threats to their firms, include the theft of intellectual property. It will be followed immediately by an expert panel to discuss board governance and oversight of cybersecurity. Both sessions will be moderated by Joseph Facciponti, PCCE’s Executive Director and former cybercrime prosecutor at the U.S. Attorney’s Office for the Southern District of New York.