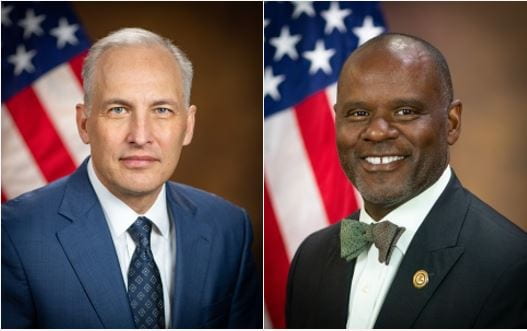

by Scott Kimpel

Photo courtesy of Hunton Andrews Kurth LLP

On May 21, 2024, staff of the U.S. Securities and Exchange Commission (“SEC”) published additional interpretive guidance on reporting material cybersecurity incidents under Form 8-K.

Since December 18, 2023, when the SEC’s rules for reporting material cybersecurity incidents under Item 1.05 on Form 8-K took effect, we have identified 17 separate companies that have made disclosures under the new rules. Since that date, several other companies also have made disclosures regarding cybersecurity incidents under other Form 8-K items. A large majority of those companies reporting under Item 1.05 have either not yet determined that the triggering incident was material, or determined that the event was in fact immaterial.