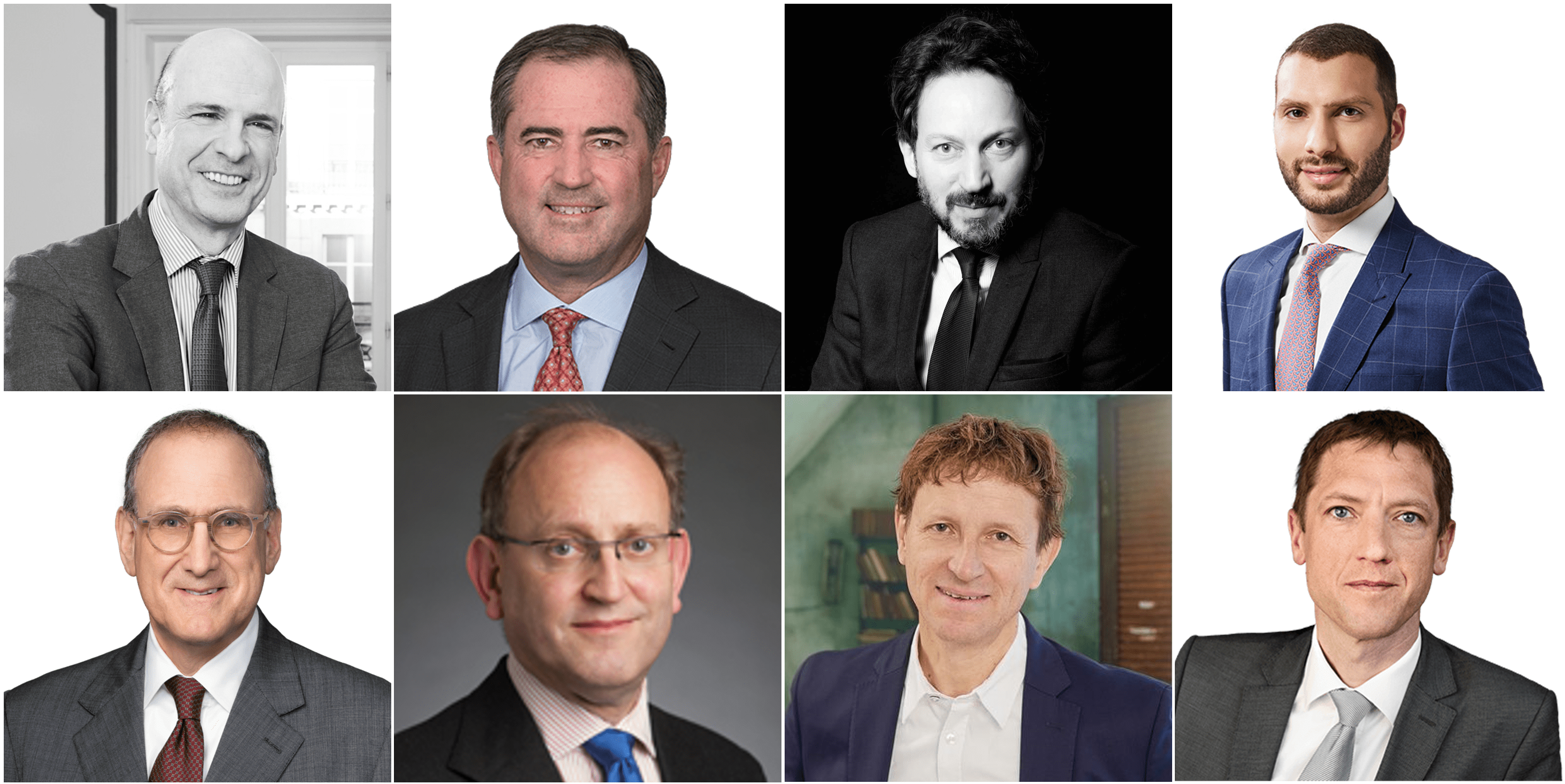

by Avi Gesser, Matt Kelly, Robert Maddox, and Martha Hirst

From left to right: Avi Gesser, Matt Kelly, Robert Maddox, and Martha Hirst. (Photos courtesy of Debevoise & Plimpton LLP)

The EU AI Act (the “Act”) has made it through the EU’s legislative process and has passed into law; it will come into effect on 1 August 2024. Most of the substantive requirements will come into force two years later, from 1 August 2026, with the main exception being “Prohibited” AI systems, which will be banned from 1 February 2025.

Despite initial expectations of a sweeping and all-encompassing regulation, the final version of the Act reveals a narrower scope than some initially anticipated.