by

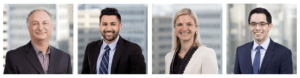

Top row from left to rugh: Nancy Libin, Adam H. Greene, Rebecca L. Williams, and David L. Rice.

Bottom row from left to right: Michael T. Borgia, John D. Seiver, and Kate Berry. (Photos courtesy of Davis Wright Tremaine LLP)

Landmark ‘My Health My Data’ Act Reaches Beyond Washington and Into the Courts With a Private Right of Action

On April 27, 2023, Washington Governor Jay Inslee signed into law the My Health My Data Act (the “Act”), which will regulate the collection, use, and disclosure of “consumer health data” (“Consumer Health Data” or “CHD”). The Act is intended to provide stronger privacy and security protections for health-related information not protected under the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), but a significant gap remains. In spite of its title and purported focus on the health information of Washington residents, a careful reading of the Act shows that it will have a much broader reach – both geographically and substantively. Most provisions of the Act come into effect on March 31, 2024, with small businesses required to comply by June 30, 2024. Some sections (e.g., Section 10 prohibition against “geofencing”) do not provide effective dates. It is unclear whether those sections become effective on July 22, 2023, which would be 90 days after the end of the legislative session, as provided under Washington law, or whether failure to include an effective date for all sections of the Act was an oversight.