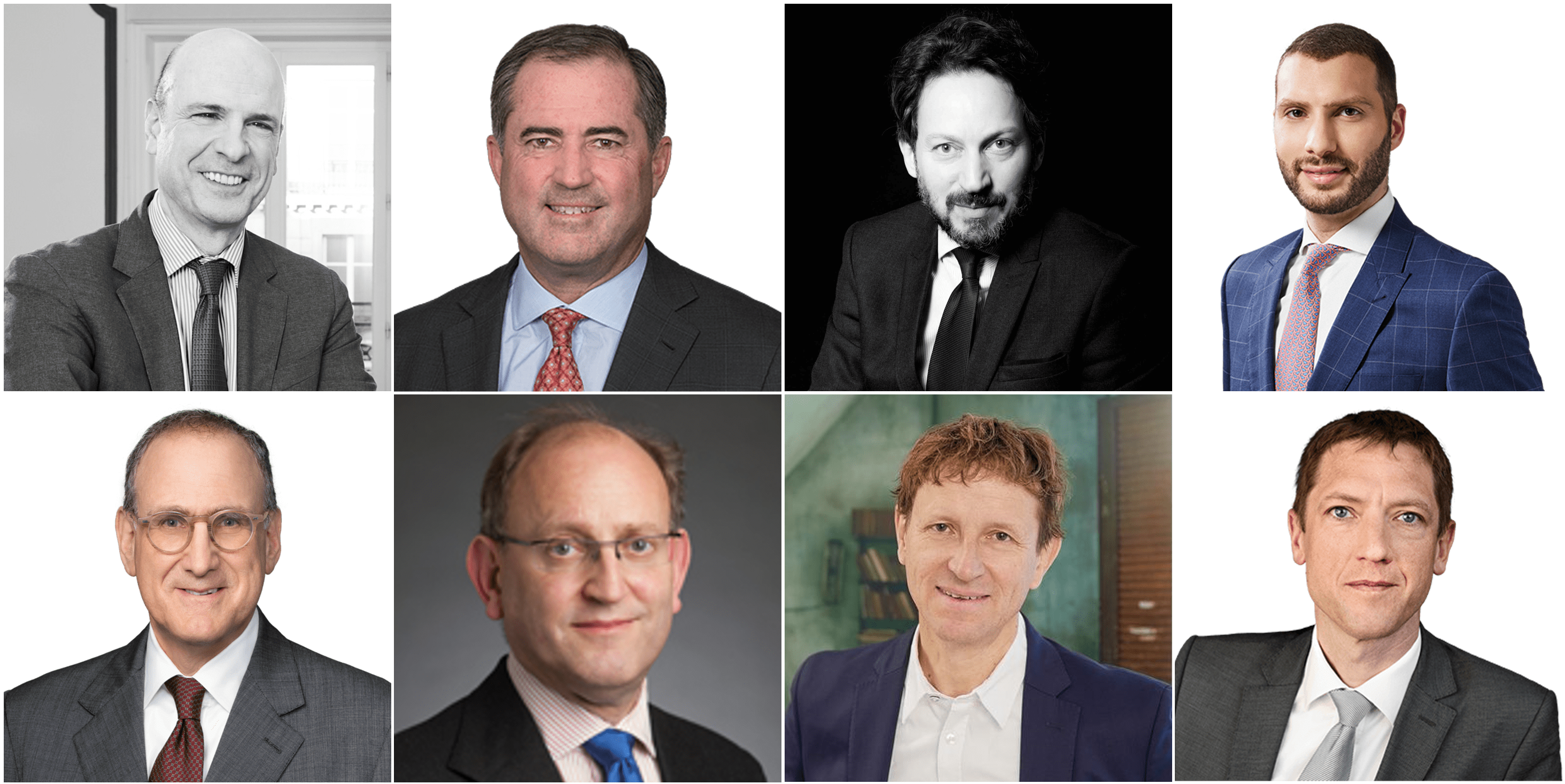

by Andrew J. Ceresney, Charu A. Chandrasekhar, Luke Dembosky, Erez Liebermann, Benjamin R. Pedersen, Julie M. Riewe, Matt Kelly, and Anna Moody

Top left to right: Andrew J. Ceresney, Charu A. Chandrasekhar, Luke Dembosky and Erez Liebermann. Bottom left to right: Benjamin R. Pedersen, Julie M. Riewe, Matt Kelly and Anna Moody. (Photos courtesy of Debevoise & Plimpton LLP)

In an unprecedented settlement, on June 18, 2024, the U.S. Securities & Exchange Commission (the “SEC”) announced that communications and marketing provider R.R. Donnelley & Sons Co. (“RRD”) agreed to pay approximately $2.1 million to resolve charges arising out of its response to a 2021 ransomware attack. According to the SEC, RRD’s response to the attack revealed deficiencies in its cybersecurity policies and procedures and related disclosure controls. Specifically, in addition to asserting that RRD had failed to gather and review information about the incident for potential disclosure on a timely basis, the SEC alleged that RRD had failed to implement a “system of cybersecurity-related internal accounting controls” to provide reasonable assurances that access to the company’s assets—namely, its information technology systems and networks—was permitted only with management’s authorization. In particular, the SEC alleged that RRD failed to properly instruct the firm responsible for managing its cybersecurity alerts on how to prioritize such alerts, and then failed to act upon the incoming alerts from this firm.

Continue reading →