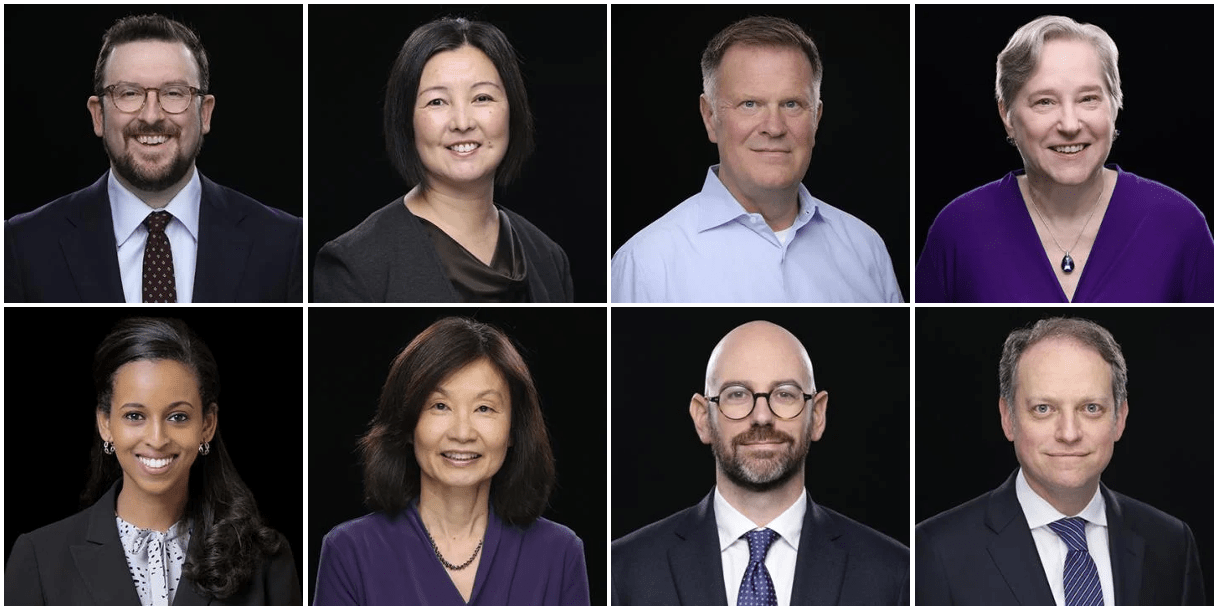

by Stephen A. Byeff, Ning Chiu, Joseph A. Hall, Margaret E. Tahyar, Ida Araya-Brumskine, Loyti Cheng, Michael Comstock, and David A. Zilberberg

Top from left to right: Stephen A. Byeff, Ning Chiu, Joseph A. Hall, Margaret E. Tahyar.

Bottom left to right: Ida Araya-Brumskine, Loyti Cheng, Michael Comstock, and David A. Zilberberg. (Photos courtesy of Davis Polk & Wardwell LLP).

Changes from the proposal include elimination of Scope 3 disclosures, scaled back attestation requirements, additional materiality qualifiers and narrower financial statement triggers. Given the lack of explicit congressional authorization for this new sweeping disclosure regime, its political sensitivity, complexity, cost and the substantial challenges already underway in federal courts, we anticipate rapid developments and possibly confusing stops and starts to unfold over the coming weeks.