by Luigi L. De Ghenghi, Boaz B. Goldwater, Randall D. Guynn, Joseph A. Hall, Justin Levine, Eric McLaughlin, Daniel E. Newman, Gabriel D. Rosenberg, Margaret E. Tahyar, and Zachary J. Zweihorn

The New York Department of Financial Services (DFS) has released guidance that expands the scope of virtual currency activity for which New York banking organizations need prior approval.

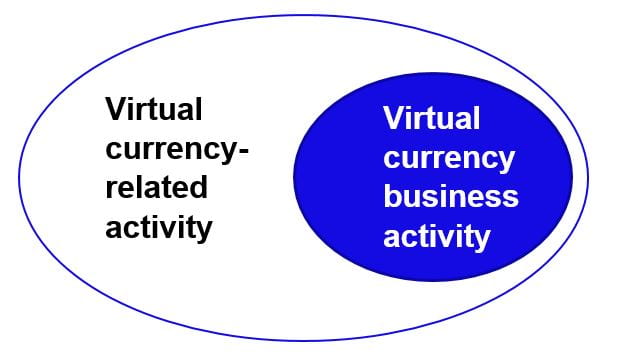

The DFS has released guidance clarifying both the scope of and application process for virtual currency-related activities by NY banking organizations (the Guidance). The Guidance expresses the DFS’ expectation that all Covered Institutions[1]—New York-chartered banks and trust companies and foreign bank branches and agencies in New York—seek the DFS’ approval before engaging in any new or additional virtual currency-related activity.[2] The BitLicense regulations have always been clear that Covered Institutions that obtain approval from the DFS before engaging in virtual currency business activity[3] do not need to obtain a BitLicense from the DFS.[5] But the Guidance requires a Covered Institution to obtain approval before engaging in virtual currency-related activity, which includes but is not limited to virtual currency business activity. The Guidance, therefore, expands the scope of activities for which Covered Institutions must seek prior approval.

In addition to virtual currency business activity, virtual currency-related activity includes “the direct or indirect offering or performance of any other product, service, or activity involving virtual currency that may raise safety and soundness concerns for the Covered Institution or that may expose New York customers of the Covered Institution or other users of the product or service to risk of harm.”[5] The Guidance provides a non-exhaustive list of activities that it considers to constitute virtual currency-related activity:

- offering digital wallet services either directly or through a third party;

- lending collateralized by virtual currency;

- facilitating participation in virtual currency exchange or trading, including by carrying fiat currency on behalf of customers;

- providing services related to stablecoins, including reserve services for issuers; and

- using digital asset technology for traditional banking activities (e.g., underwriting a loan, debt product, or equity offering effected partially or entirely on a public blockchain).

The Guidance directs Covered Institutions to begin seeking prior approval at least 90 days before the Covered Institution intends to commence each “new or significantly different” virtual currency-related activity. This is similar to the BitLicense requirement to obtain DFS prior approval for a material change to one’s business, and uses effectively the same standard to determine what may be a new or significantly different activity.

The Guidance lists detailed informational requirements that would, if drafted by a Covered Institution from scratch, likely span hundreds of pages, though these can be addressed by cross-references to existing material.[6]

The Guidance is effective as of the release date on December 15, 2022, and applies to all Covered Institutions for all virtual currency-related activities already undertaken or to be undertaken going forward. As a result, a Covered Institution currently engaged in virtual currency-related activity should promptly notify its point of contact at the DFS of the relevant activity if it has not already done so.

The Guidance is expressly non-exhaustive, and the DFS has stated that it may update it from time to time in response to new information, evolving markets, additional experience and comments or inquiries from stakeholders seeking clarification on the Guidance.

Footnotes

[1] Covered Institutions include, for the purpose of the Guidance: (1) all New York banking organizations, meaning all New York chartered banks, trust companies, private bankers, savings banks, safe deposit companies, savings and loan associations, credit unions and investment companies; and (2) all branches and agencies of foreign banking organizations licensed by the DFS.

[2] The Guidance is more detailed than similar recent guidance from the federal banking regulators, laying out specific informational requirements that a Covered Institution’s request for approval must meet or explain why they are not applicable to the specific proposal.

The Office of the Comptroller of the Currency issued Interpretive Letter #1179 on November 23, 2021; the Federal Deposit Insurance Corporation issued FIL-16-2022 on April 7, 2022; and the Board of Governors of the Federal Reserve System issued SR 22-6 / CA 22-6 on August 16, 2022.

[3] “Virtual currency business activity” means the conduct of any one of the following types of activities involving New York or a New York resident:

- receiving virtual currency for transmission or transmitting virtual currency, except where the transaction is undertaken for non-financial purposes and does not involve the transfer of more than a nominal amount of virtual currency;

- storing, holding, or maintaining custody or control of virtual currency on behalf of others;

- buying and selling virtual currency as a customer business;

- performing exchange services as a customer business; or

- controlling, administering, or issuing a virtual currency.

The development and dissemination of software in and of itself does not constitute virtual currency business activity. 23 NYCRR § 200.2(q).

[4] See 23 NYCRR § 200.3(c)(2).

[5] Guidance, note 2.

[6] These requirements include, among other things: a business plan; a thorough account of the Covered Institution’s enterprise-wide risk-management framework; a description of the corporate governance framework applicable to the proposed activity; an analysis of whether and to what extent the proposed virtual currency-related activity will have any impact on customers and other users, including policies and procedures and sample agreements; an explanation of the expected impacts of the proposed activity on the Covered Institution’s capital and liquidity; and a thorough account of the Covered Institution’s analysis of the permissibility of the proposed activity and key legal risks and mitigants.

This article first appeared as a Client Update on the website of Davis Polk & Wardwell LLP. Randall D. Guynn is Chair of the Financial Institutions practice, Luigi L. De Ghenghi, Joseph A. Hall, Eric McLaughlin, Gabriel D. Rosenberg, Margaret E. Tahyar, and Zachary J. Zweihorn are Partners, Daniel E. Newman is Counsel, and Boaz B. Goldwater and Justin Levine are Associates at the firm.

The views, opinions and positions expressed within all posts are those of the author(s) alone and do not represent those of the Program on Corporate Compliance and Enforcement (PCCE) or of New York University School of Law. PCCE makes no representations as to the accuracy, completeness and validity of any statements made on this site and will not be liable for any errors, omissions or representations. The copyright of this content belongs to the author(s) and any liability with regards to infringement of intellectual property rights remains with the author(s).