by Karolos Seeger, Patricia Volhard, Simon Witney, and Andrew Lee

On 13 December 2017, the UK Financial Conduct Authority (“FCA”) issued three new consultation papers[1] providing further details on its extension of the Senior Managers and Certification Regime (“SMCR”) to almost all firms regulated by the FCA. Some of the FCA’s key proposals are summarised below. We have previously published a client update outlining the main features of the extended SMCR.[2]

Implementation Date

The FCA has not yet decided the date by which firms will need to have implemented the SMCR, but it has now indicated that the new rules may apply to insurers in late 2018 and to other firms in mid to late 2019. We had formerly expected the extended SMCR to apply to all firms by the end of 2018.

Transitioning FCA Approved Individuals to Become Senior Managers

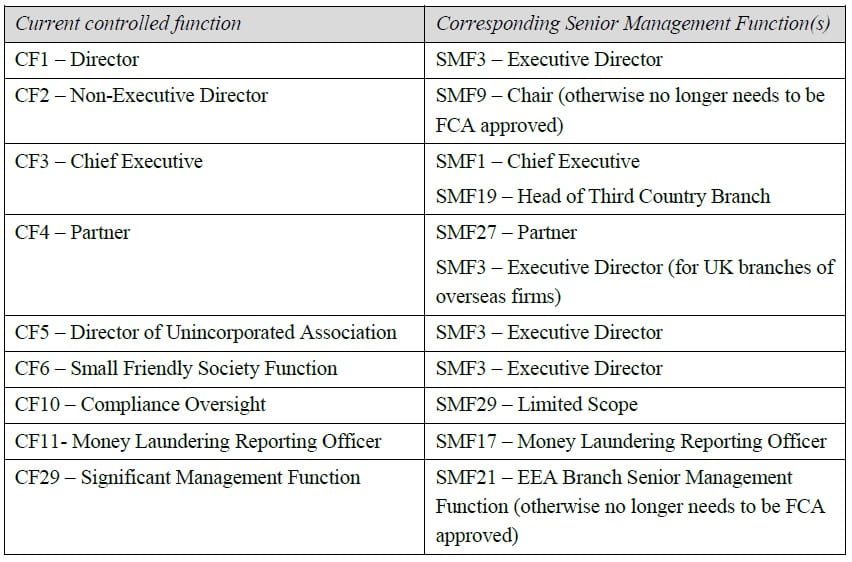

Helpfully, the FCA will generally allow individuals approved under the current Approved Persons Regime automatically to become senior managers under the SMCR, so long as there is a corresponding senior management function (“SMF”), without the need to apply for re-approval.

The table below shows how current FCA controlled functions for approved individuals will correspond to SMFs, for all firms except the approximately 350 largest and most complex UK-based firms that will be subject to the ‘enhanced regime’ version of the SMCR.

‘Enhanced regime’ firms will have to submit to the FCA a ‘Form K’ detailing all of their approved persons to be converted to senior managers, a ‘Statement of Responsibilities’ for each senior manager, and a ‘Responsibilities Map’ describing their management and governance arrangements.

Transitioning FCA Approved Individuals to Become Certified Persons

A number of approved individuals will no longer require FCA approval under the SMCR, but will instead become certified persons. These include individuals who hold the following controlled functions: CF10a (CASS Oversight Function), CF28 (Systems and Controls Function) and CF30 (Customer Function). Firms will need to have identified their certified individuals by the start of the SMCR, but they will have 12 months to assess whether their certified staff are fit and proper to perform their roles and to complete the associated documentation.

Duty of Responsibility

The FCA has confirmed that the ‘Duty of Responsibility’ currently applying to banks, building societies and credit unions (which have been subject to the SMCR since March 2016) will be similarly extended to all FCA-regulated firms.

In brief, the Duty of Responsibility enables the FCA to take action against a senior manager whose firm breached an FCA rule, where the senior manager was responsible for the firm’s activities in the relevant area and failed to take reasonable steps to avoid the contravention occurring or continuing. The FCA has already issued detailed guidance regarding the Duty of Responsibility in its Decision Procedure and Penalties Manual.

Footnotes

[1] ‘Individual accountability: Transitioning FCA firms and individuals to the Senior Managers & Certification Regime’, consultation paper CP17/40 (December 2017); ‘Individual accountability: Transitioning insurers and individuals to the Senior Managers & Certification Regime’, consultation paper CP17/41 (December 2017); ‘The Duty of Responsibility for insurers and FCA solo-regulated firms’, consultation paper CP17/42 (December 2017).

[2] Please see our July 2017 client update on the extended SMCR.

Karolos Seeger is a Partner at Debevoise & Plimpton LLP. Patricia Volhard is a Partner at Debevoise & Plimpton LLP. Simon Witney is a Special Counsel at Debevoise & Plimpton LLP. Andrew Lee is an Associate at Debevoise & Plimpton LLP.

Disclaimer

The views, opinions and positions expressed within all posts are those of the author alone and do not represent those of the Program on Corporate Compliance and Enforcement (PCCE) or of New York University School of Law. PCCE makes no representations as to the accuracy, completeness and validity of any statements made on this site and will not be liable for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with the author.