by Stephen Choi and Mitu Gulati

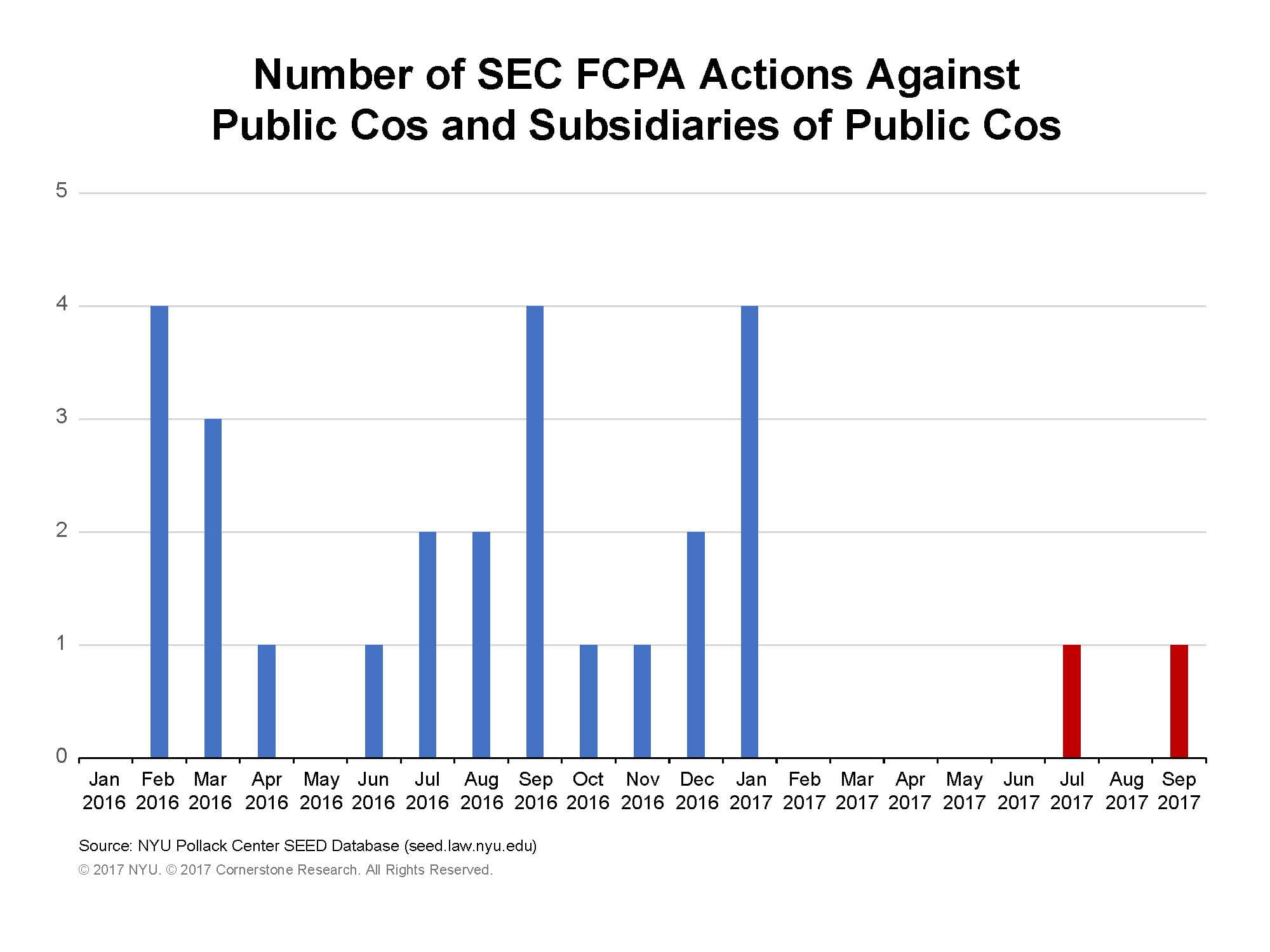

Sometimes, a graph says it better than words.

Below, is a graph by month of new Securities and Exchange Commission (SEC) enforcement actions under the Foreign Corrupt Practices Act (FCPA) against public companies and subsidiaries. Using data from the Securities Enforcement Empirical Database (SEED), a collaboration between NYU and Cornerstone Research, we track SEC FCPA actions from January 2016 through the end of the SEC fiscal year on September 30, 2017. SEED defines a public company as a company with stock that trades on the NYSE, NYSE MKT LLC, NASDAQ, or NYSE Arca stock exchanges at the start date of the SEC enforcement action. We divide our months based on whether the action was initiated under the Obama Administration (blue) or the Trump Administration (red).

As Mitu’s mother would say sometimes: There is something black in the lentils.

The two FCPA actions brought by the SEC under the Trump Administration against public companies or subsidiaries involved Halliburton Company (in July 2017) and Alere Inc. (announced on September 28, 2017, right before the end of the SEC fiscal year).

Now, for an added goodie. The FCPA prohibits, among other things, companies from bribing foreign officials for government contracts and other business. Historically, the SEC has frequently targeted companies doing business in China and Russia for FCPA enforcement actions. Of the 21 SEC FCPA actions in 2016 in our data, 48% involved FCPA violations in China and 19% involved FCPA violations in Russia. The two SEC FCPA actions in the graph above, however, did not involve China or Russia. They involved alleged illicit payments in Angola, Colombia, and India.

The foregoing is preliminary. And we are continuing to collect the data for purposes of our academic research. The following are questions we are hoping to learn more about (put differently, caveats to be kept in mind while interpreting the graph):

- Much investigative work occurs leading up to a formal enforcement action. Maybe the drop off in FCPA enforcement actions is not due to any action by the Trump Administration but instead is the result of an abnormally large number of FCPA actions in the last year of the Obama Administration (that left the cupboard bare for the new Trump Administration in terms of in-progress FCPA investigations). In 2015, the SEC brought 8 FCPA actions against public companies or subsidiaries of public companies compared with 21 FCPA actions in 2016 (and 4 FCPA actions in early January right before the Trump inauguration).

- Maybe there tend to be fewer FCPA enforcement action in the first year of an administration, regardless of who is in power – Obama, Bush, Clinton, Trump. The SEC’s FCPA website indicates though that at the same point in the Obama Administration in September 2009, the SEC had brought eight actions against public companies or subsidiaries of public companies or 4 times as many as the SEC under the Trump Administration.

- We focused on public companies and subsidiaries of public companies in the United States. The SEC also goes after companies that are not publicly traded in the U.S. On September 21, 2017, the SEC announced a FCPA enforcement action against Telia Company AB, a Sweden-based telecommunications company, for bribes to government officials in Uzbekistan (again not China or Russia). Interestingly, the SEC required Telia to pay disgorgement and prejudgment interest of $457 million, larger than any disgorgement and prejudgment interest paid by a public company or subsidiary of a public company for FCPA violations to the SEC in 2016 or 2017.

- The U.S. Department of Justice (DOJ) also enforces the FCPA. Could an increase in DOJ FCPA enforcement explain the decline in SEC enforcement? The DOJ’s website however indicates that, if anything, the DOJ under the Trump Administration is enforcing the FCPA even less than the SEC. There were no DOJ actions under the Trump Administration against a U.S. public company or subsidiary of a U.S. public company. The DOJ did bring an action under the Trump Administration against Telia Company AB that resulted in a $274.6 million criminal penalty, consistent with the outsized SEC disgorgement and prejudgment interest award against Telia. [One more caveat: Mike Koehler of the FCPA Professor Website has pointed out to us that the DOJ has brought two other actions against private companies during the Trump Administration—including actions against Linde and CDM Smith].

Stephen Choi and Mitu Gulati are law professors at NYU and Duke respectively.

Disclaimer

The views, opinions and positions expressed within all posts are those of the author alone and do not represent those of the Program on Corporate Compliance and Enforcement or of New York University School of Law. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.