1.Where can I find the short videos explaining how to read the Profit & Loss, Balance Sheet, and how to make a Cash flow statement?

They are on YouTube here:

2.Where can I find the slide deck for the “How to read a Profit & Loss and a Balance Sheet ” to share with a friend?

The deck is available here:

How to read a Profit & Loss and a Balance Sheet

How to make a Cash Flow Statement

15. Getting the numbers for this year (2023) and using numbers for different periord

We will never have the numbers for a full year because the class is taught September through December (the number for the full calendar year have not been published) or January-May ( the year has not ended).

It’s a bad idea to make comparisons with a quarter or a half year because all companies have seasonality.

The best is to use the latest figures published on an annual basis. Using the WSJ to research those numbers ensures consistency.

Be aware that many companies do not use a calendar year. For example, when posting numbers for 2023, they may mean July 2022 to Jun 2023. The best way to go about it is to add a footnote on the slide showing when their year runs. For example, Procter & Gamble 2023 fiscal year is July 2022-June 2023

15B

Microsoft’s income statement for their fiscal year ends in June, while Apple’s fiscal year ends in September. Given both statements include the years 2021, 2022, and 2023, would it still be alright to compare these two?

Yes, we’ll seldom have companies closing on the sam month, it’s ok to still compare them

14. Source for the numbers

Instead of using the WSJ, I used Nasdaq for the financial statements, since it was in a simpler format, is that ok? Dutch Bro’s and Krispy Kreme have a negative income, in that case, the percentage would be 0%.

Because for this project we are comparing with other companies, please use the WSJ to ensure the ratio of Cost of Sales is aggregated the same way, please see the previous question. When a competitor or a company has negative Net Income, please show the percentage with a negative sign. Do not use zero unless it’s zero.

13. Calculating Cost of sales

I was looking at the Statement from Chipotle and I’m not sure if I calculated the Cost of Sales correctly because I think I should maybe exclude the “other operating expenses”. I couldn’t find any footnotes on the Chipotle annual statement.

When comparing different companies is critical to use the same source and the same periods. Please use the Wall Street Journal and this line for the Cost of Sales: Cost of Goods Sold (COGS) incl. D&A

12. The 3 steps for Disney’s P&L

I am struggling to split Disney’s P&L for 2021. I found the statement, but I’m still unsure about how to divide the services

To split it into the 3 parts, do this:

- Use total revenues for revenue/Sales: $67,418

- For Cost of sales: add up cost of services $41,120 plus cost of products $4,004; total cost of sales will be $45,131

- For expenses, do it as follows:

Total revenue $67,418

Minus Net income $1,995

Minus cost $451,31

Expenses: $20,292

11. Netflix competitors

I am team Netflix. Both competitors I want to choose are part of a bigger corporation so I can’t find an income statement specifically for the streaming service. Amazon prime video is part of Amazon and Peacock is part of NBCUniversal’s. Could I use the general income statement?

Yes, it will be fine to use a competitor similar to Netflix, even though their line of business won’t be identical. There will always be variations; we just need to be aware of them. For example, Coca-Cola cannot be compared directly to Pepsi. Pepsi has a large food business. McDonald’s can not be compared directly to Burger King; most McDonald’s business is through franchisees.

One way to look up competitors would be to use the data from Thomson Reuters. “When compiling a competitor list, Thomson Reuters considers recent company filings, Reuters Business Intelligence reports, research brokerage reports, and additional sources.” The results may not be what we expect, though. For Netflix, Thomson Reuters shows as Netflix competitors Microsoft, eBay and Facebook.

Another way would be to do it as we learned in session 1: try to find the information on The Wall Street Journal. Do a Google search with these words: “WSJ Netflix Competitors.” You would get “Walt Disney Co.’s Disney+, AT&T Inc.’s HBO Max and Comcast Corp.’s Peacock, and Amazon.com Inc.’s Prime Video.” Then, look up their financials in the Wall Street Journal as well.

Another way would be to use ChatGPT.

At the end of the day, as an investor, what you care about is Return on Investment. Thus, look at the return on investment of other companies, even if they include different business units, and see how profitable they are. For example, as an investor, you cannot buy YouTube; you can only buy Google. Thus, compare Google to Netflix or Amazon to Netflix.

We’ll learn about return on investment in Session 11, ” How to Become a Millionaire Saving $5/day”. You can browse the content in the book or on the slides from last semester.

10. How can I find out the competitors for Disney and Coca-Cola

Do it the way we learned it in session 1: try to find the information on The Wall Street Journal. Do a Google search with these words: WSJ Disney Competitors; or WSJ Coca-Cola competitors

While we are at it, Erika contributed the good idea of looking up the financials in the Wall Street Journal as well. Search on Google for “Disney financials WSJ” and then click on Financials, Income Statement. You will find Sales/Revenue; Cost of Goods Sold excluding D&A (same as Cost of Sales) and Net Income. Calculate Expenses as the difference (Revenue minus Net Income minus Cost of Sales excluding D&A =Expenses)

9. The easiest way to calculate all other expenses. Net Income or EBIT?

When I was reviewing your assignment, I was confused by the ‘all other expenses’ – do they include tax expenses? And about the ‘net earnings’, should they be ‘net income’ or EBIT or operating income in the statement of operations?

The 4 items you need to look up are revenue, cost of sales, expenses, and net income. In the case of IBM, from their annual report, you can easily see these numbers:

Revenue $73.6 B

Cost of sales $38.0

Net income $5.6

For IBM, there are 12 lines between cost and net income. Instead of adding them manually, it’s much easier to calculate it as a difference:

Expenses= Revenue minus cost of sales minus net income or

$73.6-38.0-5.6=30.0. Expenses (all of them) are $30.0 Billion

Regarding whether to use net earnings, net income, EBIT or operating income, use Net Income. As we learned in class, different companies use different terminology. Other may use Net earnings instead. You are looking for the line at the very bottom, once all deductions for all factors were made.

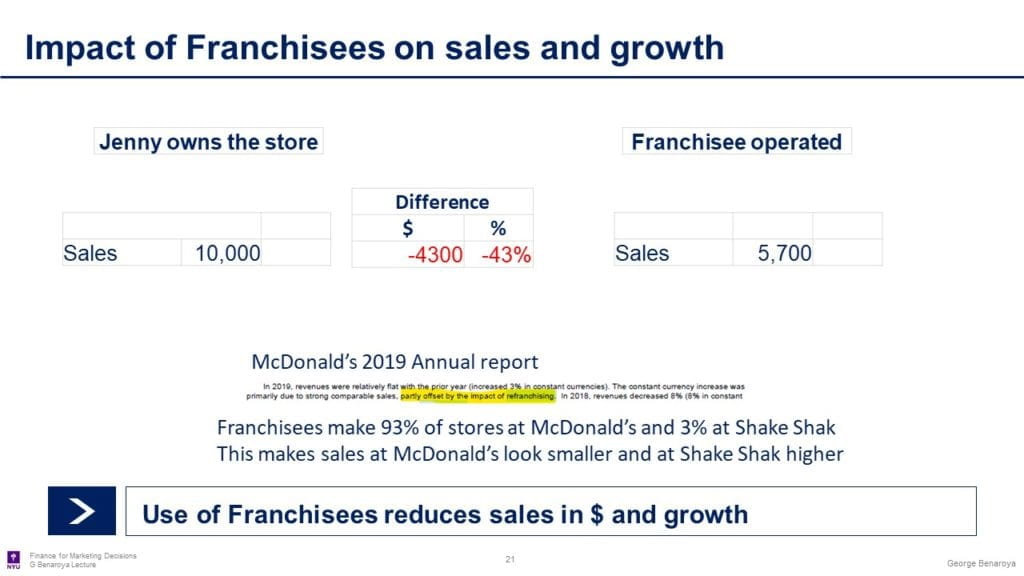

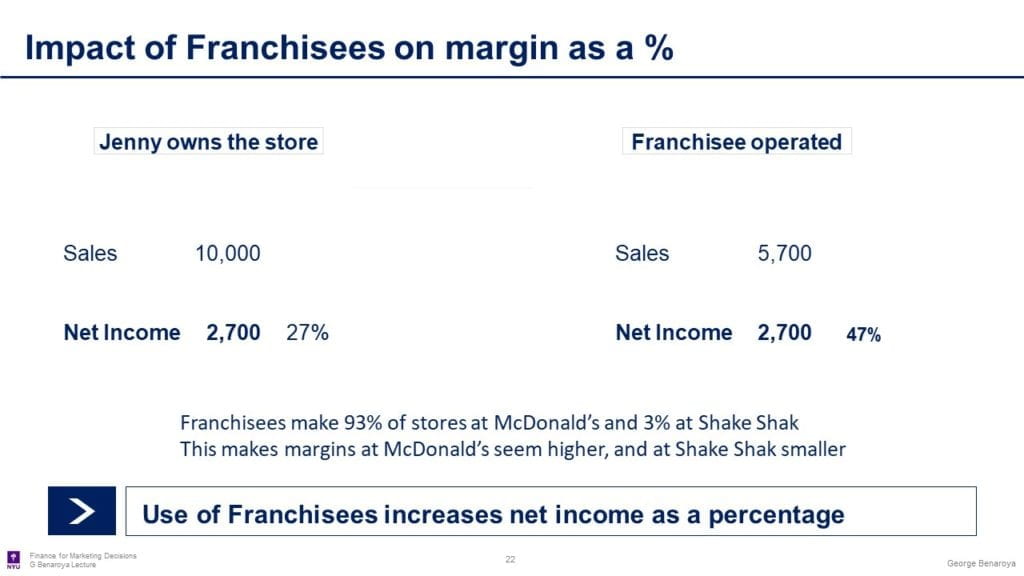

Use of Franchisees and Distributors. Impact on Financial Statements

8.When I compare the ratios for McDonald’s and Shake Shack, they seem to be very different. Is there something else I need to be aware of?

Yes. The use of Franchisees impacts sales and margin as a percentage. Franchisees make 93% of stores at McDonald’s and 3% at Shake Shak. This makes sales at McDonald’s look smaller and at Shake Shak higher. It also makes margins at McDonald’s seem higher, and at Shake Shak smaller.

The same effect occurs at Nike, where 70% of sales go through Distributors or Wholesale. This makes sales look smaller and margins higher than using a DTC (direct to consumer model).

To illustrate this effect, let’s use Jenny’s example we use in class. Jenny sells 10 pairs of shoes at $1,000 each, which cost $300 to make.

| Sales | 10,000 |

| Cost | (3,000) |

| Expenses | (4,300) |

| Net Income | 2,700 |

Imagine Jenny doesn’t want to operate the business anymore, and Mary is willing to run it as a Franchisee. This is ideal because Jenny won’t need to disclose where she gets the shoes for $300 which she sells for $1,000.

Price

When you go to McDonald’s you pay $5.77 for a BigMac, regardless of whether the store is company-owned or a franchise. When you buy Nike Joyride sneakers, you pay $180. It doesn’t matter whether you buy it directly from Nike or at Macy’s. Jenny realized that the price to the consumer should remain unchanged, $1,000 for each pair of shoes.

Cost to make the shoes

Whether you buy the Nike sneakers at Macy or a Nike store, the cost to make the shoes was exactly the same. They didn’t change the raw materials. The cost to make the shoes for Jenny will remain the same at $300 or 30% per pair of shoes.

SG&A

When Jenny uses a franchisee, she will have lower expenses. Mary asked her to get the shoes at a lower price, so that then after the expenses she can sell them for $1,000. Jenny agrees to reduce the price she charges Mary by 43% or $430, the amount she used to spend on Expenses. If we look at the P&L for Jenny, now it would look like this:

| Sales | 5,700 |

| Cost | (3,000) |

| Expenses | 0 |

| Net Income | 2,700 |

Net Income

Net Income remains unchanged in dollars. She is still making $2,700.

Impact on Sales and Sales Growth

Now, imagine that we look at her sales in January, when she was operating the store. The sales were $10,000. In February, when she is using Mary, a Franchisee, sales have dropped by 43% or $4,300.

Impact on margins

Let’s do the same for margins as a percentage. In both January and February, her net income is $2,700. However, as a percentage of sales, in January it was 27% (2,700 divided by $10,000). In February, it increased to 47% (2,700 divided by 5,700). The use of Franchises has a positive impact on margins.

7. In McDonald’s P&L there is no wordings like cost of sale used. However, they have written Company – operated and franchised restaurant expenses. Does this come under cost of sales?

Yes please include it as cost of sales.

6. I have some questions about the Profit & Loss assignment. Is it correct that I should mark the cost and expense as red if they are spending more money?

Coloring helps readers of a financial table better understand the impact of the numbers they are looking at.

Some ratios can be difficult to color though. For example:

- In a growing company, expenses may be increasing just because their Revenue is also growing. Revenue in Disney grew from $59 Billion to $70 Billion, so it’s expected that it will grow some. Thus, it may be better to leave the dollar amount uncolored, and use a color when the percentage of revenue is growing (red) or decreasing (green). What a growing percentage of revenue is saying is that the company is growing expenses faster than revenue.

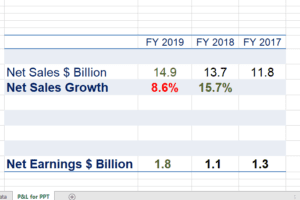

- In your example below, remove the colors in the dollar amounts for all figures in FY 2019 except for Total Revenue and net income.

- In the revenue segment, remove the colors also for the percentages for products and services.

- I’ve noticed that you also added a column for YoY growth. I would probably remove all colors, but leave the ones just for Total Revenue and Net Income. For Total Revenue, should we use green? Yes, we probably should because in 2018 they grew 8% and now 17%. We could also compare that to how much the market has grown. If the market has grown 17%, then shouldn’t color it green (we are just keeping up with market growth). Net income in dollars has decreased by 12%. That deserves a red. While it’s usually better to look at ratios as a percentage of sales, we need to remember that at the bank we can’t deposit percentages. They only take dollars and euros.

5. The percentage of sales is for Estee Lauder. How do I calculate it for Nike?

To calculate the percentage of sales or revenue, use this process:

Take each ratio, and divide it by sales. In the example, we use for Jenny:

Sales 10,000

Cost of Sales 3,000 30% of 10,000

Expenses 4,300 43% of 10,000

Net Earning 2,700 27% of 10,000

Use YOY (or growth) only for Net Sales. For other ratios use % of Net Sales

4. How can I tell what numbers should I include in my summary Profit & Loss table?

In general, you want to look for

- numbers that are large, or

- have changed significantly, and

- Management can do something about it and

- will help you explain the change you are looking for. That is if you are trying to explain an improvement and found only negative drivers, keep looking for something positive and vice-versa.

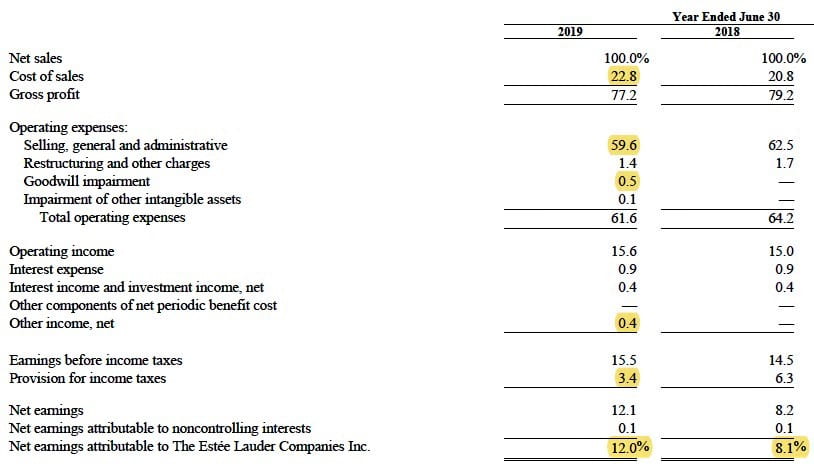

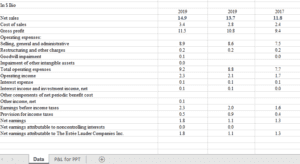

The easiest way to do it is by looking at the P&L as a percentage of Net Sales. Estee Lauder publishes it on that basis. This is what it looks like:

This is what we see:

Their Net Earnings (the last line) improved from 8.1% to 12.0%. Why was that? We want to explain something positive worth 3.9%.

In order of magnitude, this is what we see:

SG&A improved by 2.9%. Why? Was it because sales increased faster than SG&A or because they reduced expenses?

The cost of sales worsened by 2%. Why?

There are also other items, for which management has less or no control.

The provision for income taxes was reduced by 2.9%. Why?

As well as changes to Goodwill and Other income. Those 2 items are relatively small though. The “big money” is in the cost of sales and SG&A.

Hope this helps.

3. I am having trouble finding numbers and I am not sure how the math is calculated. What can I do?

This is what I would recommend:

1.Do the numbers in excel first, it’s easy to then edit, copy, paste them to PPT.

To help you, this is what I did

-Created a sheet called P&L for PPT in excel. When you do it in excel, use the same format you will use in PowerPoint, by doing that you save time when you copy, paste it.

- Copied the number from the annual report to a sheet in excel I named “data”. Students who are working in Estee Lauder can download it from Assignment 4 (I realized it will be easier for you to find it there). Those who work in another company, the way to do is this: select the data from Adobe, right-click on it, click on export selection as a worksheet. You need Adobe Professional for it. If you don’t have it, you can download, for free, as an NYU student (and use it for other things too).

- The numbers were in percentage, so I calculated them in dollars as well by entering the net sales in $ and then multiplying each cell.

- Now you have all the data in the sheet named data. Look at rows 25. Through 43.

Next, think about the next step as a puzzle. Look for numbers you like, and bring them to the P&L in the PPT sheet. I did Net Earnings and Net Sales so you can see how to to it. I also added the formula for sales growth. Whatever you put in between, it needs to add up to the Net Sales and Net Earnings. For example, if Net Sales is 14 and Net Earnings is 2, then all cost and expenses must be 12

Enjoy it.