This material is in the public domain to foster education. It can be reproduced anywhere and in any language.

It cannot be used for commercial purposes. You are not allowed to use this content if you charge for it, or receive compensation for it.

19.Net margin too high or payback too short

If we only take marketing investment as expense, that will be only 5%, and the net margin will be huge high, which is over 40%. Does it make sense if we just use the expense shown in annual report, that is 42% to calculate our data?

If the payback is too short, or the net income is too high, that is likely because your marketing investment is too small. The reason why you cannot use such a small investment in marketing is that when you launch a product, your incremental sales are very small. That is why you need to invest 10X more than you normally do, as an example 50% instead of 5% of incremental sales in year 1.

As a rule of thumb, During the first year, make a marketing investment which results in a net income of -10%. If your net margin is 40%, invest an additional 50% of incremental sales the first year.

The steps are as follows:

Step 1: your numbers:

mkt investment 5%

net margin 40%

Step 2:

Increase marketing investment to 50% of incremental sales on year 1.

The net margin on year 1 will be -10% only for those incremental sales. For the total company sales, the change will be very small

Step 3

For the following years, revert to a maintenance marketing of 5%. You net margin will be 40% only for those incremental sales. For the total company, the total net income will not change much

18. Historical growth

On our incremental sales, do we need to include the historical growth of for example 12.9%?

No, the incremental sales should only include strategic ideas above and beyond what the company is only achieving for growth. The growth number on the waterfall should include only incremental sales above and beyond

17 Payback

17.1 Do we need a payback for each strategy?

Not only for one. Best if it is for the largest one that you are presenting first. Remember you will be presenting the one with the highest incremental sales first saying.

17.2 How many rows should be on the payback?

At least as many as it is needed to have the project payback. Do not assume that they payback is less than a year. For marketing investment, invest at least as much as to get the net income to -10% the first year. For example, your gross margin is 50% Assume that you will invest 60% in marketing and other costs, so that they first year, you will not achieve payback.

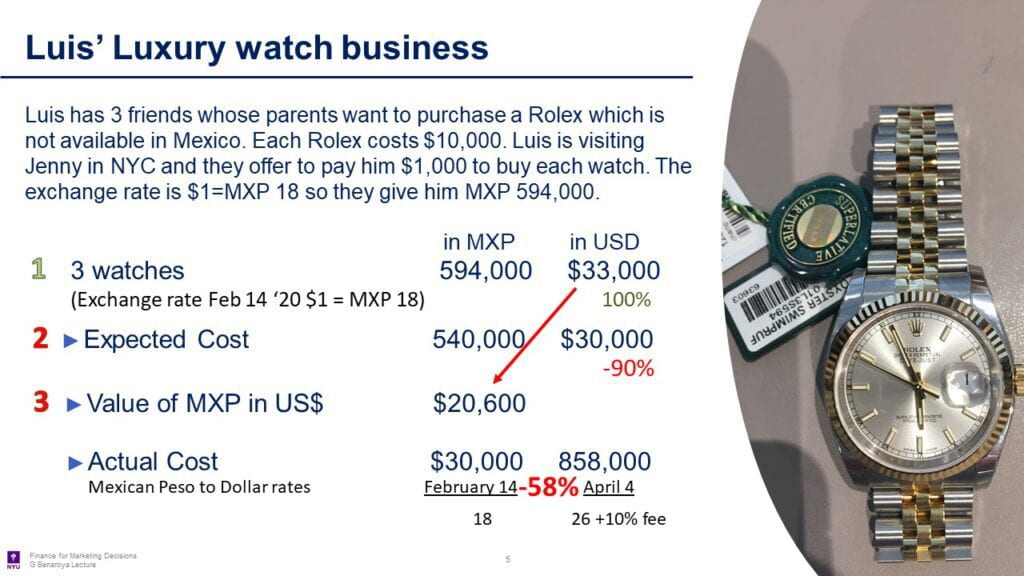

16. What currencies should we use?

It’s ok to report all data in Dollars, Euros or Swiss Francs. For any other, please convert to dollars.

15. Market share and forecating revenue

Our strategy is about increasing market share in China and Japan for our Selective Retailing sector. We have found the CAGR of of both Japan and China, we also have the forecasted market size of both countries, and the past sales worldwide of our selective retailing sector. However we don’t really know how to proceed. How can we use these numbers to found out how much we personally believe our strategy will help us grow? Can we average the CAGR of both countries?

Great job researching the CAGR of both Japan and China, and the past sales worldwide for your selective retailing sector. Here are some tips:

No, we shouldn’t average the CAGR of both countries, we need to use a weighted average. China is likely to be bigger than Japan, and that needs to be accounted for.

We can use the worldwide sales of the retailing sector, as a base for Japan & China. For example, assume that the weighted average CAGR of Japan and China is 10%, and worldwide is 5%. We then know that Japan and China are growing twice as fast as the rest of the world. If the selective market worldwide is growing 2%, it’s reasonable to assume that for those two markets it will grow by the same proportion, twice as much as the world, or 4%.

14. Regarding net income waterfall, should we estimate numbers based on past data and predicted expenses using the formula: net income = revenue – cost – expenses?

Please read also the response to question 5, 7 and 13.

For net income,

- Get the financial statements for your company. For example, if it’s Samsung, Google WSJ financial statements, Samsung. You will see that the net income is 18% of sales.

- Target that you will reach the same percentage of net income as the company in general. There will be some items where you will spend less and others such as rent where you will pay more.

- If the strategies you are proposing include an increase in marketing investment, reduce the net income by the same ratio. For example, Samsung’s net income is 18%, and its marketing expense is 3% (not the actual number). You are proposing for your strategy to increase advertising to 10% (a 7% increase) of sales. For the net incremental sales of your strategy, use a net income of 18% minus 7%. If the strategy you are using includes R&D of 20% and Samsung spends 3%, the delta is 17%. Then, for your net income on incremental net sales, use a net income of 1% (18% -17%=1%).

13. Financials Checklist for a Capstone project

How can I know whether my financials are correct?

- Get the financial statements for your company. For example, if it’s Samsung, Google WSJ financial statements, Samsung. You will see that the net income is 18% of sales.

- Do extensive research on sales. That is a number that has got to be right. Be able to explain in a succinct but rational way how you calculated the numbers.

- Target that you will reach the same percentage of net income as the company in general. There will be some items where you will spend less and others such as rent where you will pay more. Rent in New York City is extremely expensive. Have real data to show the rent cost.

- Have few numbers which are realistic. The audience will believe them.

Be careful with these common mistakes:

- Rent is not an investment; it’s an expense. It goes in the P&L, not in the Balance Sheet

- Carefully estimate all the improvements that you will make to the store, which are expensive.

- Payback is always in months or years, never a dollar amount. For a marketing project, a 1-year investment is reasonable. For launching a new product or store, it is not. Those projects take five years or more to pay back.

- Breakeven is the number of units you must sell to recover all costs and expenses. It’s a “unit” number.

- Return on investment is always calculated on an annual basis.

12. Launching an extension through a losing money business

Should we reconsider our innovation strategy despite the potential in developing a new smart home security system using Alexa as inspiration? Market research shows a substantial demand for this segment, with an estimated market size of USD 28.52 billion in 2023, projected to reach USD 54.45 billion by 2028.

However, Alexa’s system has been financially unprofitable, reportedly on track to lose $1 billion this year. While Amazon continues to invest in Alexa’s ecosystem, our objective is profitability. Given this evident loss in past earnings and news reports, should we persist with our current strategy or reassess for a more lucrative approach?

What you are proposing to launch is new smart home security system, using Alexa. You are worried about the fact that loosing money on Alexa. This are two separate issues. One is what you are going to sell and the other one is how you are going to sell it.

Regarding the what you are going to sell, you need to do extensive research to respond to the five questions

1.What are you going to sell?

2.How much are you going to charge for it?

3.How and where are you going to sell it?

4.Why would someone buy it?

5.Where else in the world is that product or service sold and what are they doing right?

6.Why would someone buy your product instead of one that already exists?

7.How much net income are you going to make? Will you cannibalize existing products?

The drawback selling it through Alexa is that only users of it will be able to utilize it. Quantify the advantages of selling it through Alexa compared to without it. By doing this, you may be able to see that you while you can sell it through Alexa, that is not the only channel.

11. There is no data for ESPN. Can we use data from a similar brand?

See answer 6

10. It’s hard for us to calculate the net incrementa revenue for our strategy. Could you give us some tips on how to do it?

Here are the steps you could follow:

- Research the market size

- Research who has the leading market share

- Decide whether you will steal market share from the main player or grow the market

If there is no information about that market, use a reasonable assumption. When the iphone was invented, that’s what Apple did. You won’t be penalized for making an educated guess based on facts, you will receive full credit for taking the time to do the research. All those slides should go into the annex.

9. How do I calculate the CAGR-Compounded Annual Growth Rate

https://cagrcalculator.net/result/

8. I’m writing about the net income for Apple’s strategic plan. We can not find Apple’s net income by category. Can we go by the ratio of annual net income to annual revenue or just delete the net income from our strategic plan? Could you give us some advice that how we should deal with this data?

No, you cannot delete Net Income. On the Strategic Plan instructions, it’s clearly stated that you must quantify the incremental impact on Net Sales and Net Income for all strategies. As a marketeer, make it a habit to always quantify the financial impact of your recommendations. If you are recommending increasing sales of a product that is losing money, you will increase the losses by selling more of that product. You should first find a way to make it eventually profitable.

Have one team member do extensive research on the profitability of each strategy when you start. This research material should be included in the Annex. Yes, you can use a ratio if you are unable to find any material on the approximate gross margin of all products. See the response to questions 5 & 7.

7. To calculate payback, how do I estimate revenue? How is the net margin determined? How can I estimate the marketing investment?

Let’s start with the easy part, how NOT to do it.

Revenue

You need to look at the marginal increase in revenue, and what you are going to add thanks to the idea you propose. Imagine that your company is Pfizer. You shouldn’t look at the last two years with the pandemic (that is true for any company). If you go back to 2018 compared to 2019, you see that they grew their revenue by about $1 Billion dollars on sales of $40 Billion. That’s about 2.5%. That includes pricing and volume. Therefore, whatever you propose, your idea should contribute well below $1 Billion dollars. Do not estimate sales will grow by $30 Billion.

Net Margin

As mentioned in a previous question, it would be ok for you to assume that you maintain the same net margin as the previous year. Look what that number is in the annual report.

Marketing investment

First, look at how much money your company invests in marketing. For example, if you go to Pfizer’s annual report, do CTRL F and search for the word “marketing”, you will find that “Advertising expenses totaled approximately $2.0 billion in 2021”. That’s 2.5% of sales of $80 Billion. Use what you have learned the company has been growing per year (excluding the Pandemic) and their overall marketing investment to do a sense check.

6. How can I justify my $1 Billion investment idea for Disney?

Invest $1 billion into releasing 100 new movies on Disney+ each year. • Increase the subscription fee to $5.8/month.• Maintain a 20% margin on 100 million subscribers

- Do research to find out whether 100 movies will cost $1 Billion. The easiest way is to look at how many movies Disney or Netflix release per year and the investment they make for it.

- When you find out how many movies Disney releases per year, you need to compare that to your proposal to make 100 movies. Is that realistic? Is it a lot? Is it 30%, 50%, or 100% more than they currently do?

- Check whether Netflix has a net margin of 20% from its latest annual report. You need to use that margin.

- Do a sense check on your proposed increase of $5.8 per month. What percentage is it? Has Disney ever increased prices that much? How would the new price compare to competitors?

5. How we can get numbers for strategies that may not be present in the income statement or is new and haven’t generated any revenue?

To estimate the sales, look first for the market size for a category similar to what you are launching. Use Statista or Passport. Both are available for free at the NYU library. Once you know the size of the market, estimate what market share you will achieve. For example, if you are launching a new coffee product and the market size is $100 billion, you can estimate you will achieve a market share of 1%, therefore your sales will be $ 1 Billion.

To calculate the gross margin, if you cannot find financials for your category, assume you will achieve the same gross margin and net margin as the rest of your company and use those numbers.

5B. Our team wants to launch a new health juice product line at Starbucks. I found a report on the forecast Pressed juicery growth to 2030, I thought I could refer to this data for Starbucks Growth Sale. The CAGS is 7.2%. How do we calculate the incremental sales

In the photo, you sent me you also show that the market size is $1.4 Billion. As I mentioned for Q5, these are the steps you need to do:

1. Calculate the market share you are going to achieve. Out of $1.45 Billion, how much? Best if you can do it based on another launch Starbucks did. For example, imagine you figure you will get a 10% market share. Then your base will be $145 Million and the CAGR 7% per year. For margin, use the overall gross margin of Starbucks

2. Estimate the cannibalization effect. If you launch this drink, customers may NOT get a frappuccino and one of these. It will be one or the other. Therefore, your Net Incremental sales may be 0. You sell $145 Million of this but $145 Million less of Frappucino. You need to make sure that your product launch will not cannibalize your existing product line. This is hard to estimate. I am fine that you make an assumption, but I want you to please do it so you don’t forget when doing this type of analysis.

5C If I have the revenue of a company that does the strategy that I am doing(in my case specialty coffee can I use their revenue) as an indicator since it is a much smaller company? Also if only have the CAGR of the industry (in this case 12.4%) do I use that or how do I calculate/estimate the CAGR for the strategy?

Yes, it makes sense to use the sales of a similar smaller company.

Yes, it makes sense to assume the industry’s CAGR. Well done for researching those numbers.

5D. My numbers are as follows. How do I calculate cannibalization?

Revenue $327 Million

Gross Margin (for Payback) 20%

Net Margin for Net Income 10%

Price index to normal coffee is 2X

You will need to calculate what percentage of consumers will drink your coffee in addition to a regular one, or, will go to Starbucks just because you have that coffee and they wouldn’t have gone otherwise.

Assuming that you will get 50% of consumers to get this coffee that would be 50% of $327 Million or $163 million. The reason why we don’t double the sales to account for the difference in price is that the sales of $327 Million already take that into account.

4. What goes in the main deck and what goes in the annex?

The main deck should contain 30 “beautiful slides”, with short text and great impact. The audience may get lost reading the details instead of listening to you otherwise. All slides with long text go in the annex. Some people like details, so you need to make sure that any statements made are well-supported.

Details can be found on

- Slide 5 of the Strategic Plan presentation

- Points 3 and 8 on the checklist on slide 26

3. Which years should we use, 2021 to 2025?

See also the same question from last year below.

You need to go at least 3 years into the future. Since we are in the middle of 2022, that will be 2023, 2024, 2025

For this year, you can use an estimate of the full year 2022.

You will want to show at least 1 year going back. The templates on the PPT will show you how other students did it in the past. Some used a total of 10 years, others 5. The minimum is 1 going back, the current year, and 3 going forward.

2. How to estimate the current year 2021

For the current year, since we don’t have the numbers yet, what can we do? We will be using 2020 data from the Annual report as our base data. After this, should we project for the years 2021, 2022, and 2023? Or should we do 2022, 2023, and 2024 and leave out 2021 as the year is almost over and the strategy will not be useful?

Yes, it doesn’t make sense to make a strategy for 2021, since the year is almost over. What you are doing is best: please use the published 2020 figures for the annual report as your base.

However, due to the fact that 2020 was impacted by the pandemic, please do estimate the numbers for 2021 by annualizing the year-to-date figures line by line for the second quarter. To annualize it, simply multiply it by 2. The numbers are here:

https://newsroom.ibm.com/download/BW+2Q%2721+Earnings+Release.pdf

For example,

Revenue for the six months ended in June 2021 is $36,474 M. For the Full Year 2021, assume it will be twice that or $72,948

Cost of Sales for the six months ended in June 2021 is $19,266 M. For the Full Year 2021, assume it will be twice that or $38,352. You arrive at the cost of sales by deducting Gross Profit of 17,208 from Sales of 36,474.

Expenses for the six months ended in June 2021 is $14,927, assume it will be twice that or $29,854. We calculate all expenses as a difference: 36,474-19,266-2,281=14,927

Net income for the six months ended in June 2021 is $2,281 M. For the Full Year 2021, assume it will be twice that or $4,562

1. For the Estee Lauder strategic plan, can we increase market share by buying companies or brands? Lancome is owned by L’Oreal, and Serge Luten by Shishido. I would like to add those to my Strategic Plan.

Yes, you can. The acquisition will immediately increase the market share for the category. Estee Lauder will own a greater share of fragrances. It’s only through good management however that those brands will prosper and the M&A will make sense.

To properly value an acquisition, we look at 7 building blocks. That is above and beyond concepts like NPV, IRR, and payback. For now, do this:

1.Ask yourself, why would Estee Lauder be better at managing these brands?

2.Do a Google search (or better through Nexis) for these terms:

- Procter Gamble writedowns

- L’Oreal writedowns

- Estee Lauder writedowns

Try to find out why other companies overpaid for M&As and mention in the Strategic Plan what measures you will assume not to overpay.

About the waterfall

Watch a video I made with step-by-step instructions here:

https://nyu.zoom.us/rec/share/7E35KqB96pZrOQXtaZ9yAvsdYRb4dSWiSPKSR4_5Qp3G15es0hQrPuM05Gx9lcHh.YBksx0Syf0ET57j2?startTime=1601060959000

I have encountered a problem with my homework. Now I need to convert excel to waterfall in PPT, but when I copied the blue part of the data in excel and paste them to the waterfall template in PPT, I found that all the data became 0. I try it many times, but the waterfall can not formed. I’m not sure if there is a problem with my excel or my operation? I attached my Excel to the email. Please enlighten me further. Thank you very much.

This is what your data looks like:

There are 3 reasons why you may be having trouble:

- The range of the axis

In your case, the sales range from $266 to $260, but the scale of the axis is set to 10-30

Please change the scale of the axis to a maximum of 300 To do this:

1.Stand on the axis

2.Right click on it

3.A format axis will appear in the right-hand side

4.Change the range to a maximum of 300, with an interval of 100

The chart will then look like this

Next, we need to change the order of the data

2. Order of the data

We need to list the changes in decreasing order for the colors to be automatically updated in proper order. This will also make it easier for the reader to see. Swap the order of Service and Iphone

Your chart will then be ready to use and it will look like this:

3.Not copying data as values

When you copy the data into the Powerpoint, make sure to copy it as value.

If this solves the problem, please let me know.

When I’m pasting my excel (orange & yellow table) results into the template in PowerPoint, the result returns zero every time and thus ruins the whole waterfall.

There are 3 reasons why you may be having trouble:

- The range of the axis

In your case, the sales range from $21 to $13, but the scale of the axis is set to 10-15

Please change the scale of the axis to a maximum of 25 and a minimum of 0. To do this:

1.Stand on the axis

2.Right click on it

3.A format axis will appear in the right-hand side

4.Change the range to a maximum of 25, with and a minimum of 0

Next, we need to change the order of the data

- Order of the data

We need to list the changes in decreasing order for the colors to be automatically updated in proper order. This will also make it easier for the reader to see.

Your chart will then look like this:

Finally, change the color for Media Networks and Studio to red (right-click on it and change data point) Then the chart will look like this:

3.Not copying as values

When you copy the data into the Powerpoint, make sure to copy it as value.

If this solves the problem, please let me know.

When transferring the data from the excel sheet to the waterfall template, the data seemed to transfer but two of the lines in the waterfall were not drawn (fragrance and haircare). Each of these categories had the number 0 but no line was drawn below or above it. However, I noticed with my “other” column, though it read as 0 when looking at the data on excel it actually was 0.02, so there is a line even though it still says 0.

I went ahead and changed the “upper box” number on both fragrance and haircare to 0.01 and now it shows a line. Is that incorrect to do? I just wasn’t sure of another way for there to be a line drawn to represent 0.

The reason why PowerPoint doesn’t draw a line is that the value is zero. These are the solutions

- The safest way would be to change the cell in the orange box to a number greater than zero (0.01 or higher). That way you leave the formulas unchanged.

- Yes, you can also do what you did

- The other way to do it is to manually draw a line. Too much work in my opinion.

Link to Strategic Plans

Below are the links for Strategic Plans submitted by other students, or click here