This section is to respond to questions from students only. To comment on an Assignment, please go to the respective assignment (scroll up)

Explaining Sales growth

1.Calculating the variance

To calculate the variance, delta, or difference follow this steps:

1.Begin with the end. Compare the sales of Period 1 with Sales of Period 2. For example, if sales in 2021 were 100 and in 2022 were 120, the variance is 20.

Then, try to find out what were the drivers for that change of 20. You need to identify four drivers that add up to 20, by following the same process.

2. Companies changing the way that they report

For Disney, I tried to compare their Revenue in years 2021 and 2019. I found that Disney changed the format of P&L. Could you please suggest how to compare the Revenue?

Let me try to respond to your question and then add more on what would be the best way to go about it

Companies frequently change the way they are organized, which makes historical comparison much harder. Here is how to solve the Disney comparison

1.Begin with the end: you need to identify 4 different buckets for the sales change

In 2021, you have the data displayed into 2 main buckets:

Disney Media and Entertainment Distribution

Disney Parks, Experiences and Products

2.What you want to do is to identify 2 other buckets that are big. Linear Networks in the new reporting is similar to Media Networks in the old reporting. Isolate that as the third bucket. Then try to find a fourth bucket that is similar in both periods. The difference will be “Other”

Having said that, the disadvantage of doing this way is that this would be an “accounting” sort of explanation. It would be much better if you were to first look at the growth in sales from 2019 to 2021, and then try to find the main drivers by doing research on Disney. For example, the streaming business is likely to be an important driver. What you could do is separate that as one of the drivers, and then try to calculate the difference for other segments. If you do that, please make sure that: 1)your total sales numbers tie with what is on the annual report 2) the drivers you identify are not double-counted.

3.I did not want to use the same example you showed us in your video to show the sales growth from 2018-2019, but after looking at previous years, 2018-2019 has the most increase in sales growth reflected. Will that be ok to use even though it will reflect the same as your example in the video?

Yes, you can use the same periods I used in the video.

The objective of this assignment is for you guys to learn how to explain the change in sales growth from one period to the next. You could also use other drivers, such as regions of the world.

4.Finding the drivers of Sales growth in the Annual reports

I’m basing this off of McDonald’s 2018 and 2019 annual reports. Total revenues:

McDonald’s 2018 Revenue = 21,025 billion (rounded up to 21.03 billion)

McDonald’s 2019 Revenue = 21,077 billion (rounded up to 21.08 billion)

So these two values would be the outermost columns for my waterfall. With an increase of ~50 million in-between.

Yes, the difference will be 0.05 Bio. You will have $21.03 and $21.08. It’s better to keep it in Billions to make the point that “it’s a rounding.” For 2020 vs 2019, it’s a whole different story.

I’m also struggling to find 4 or 5 drivers since McDonald’s annual report does not break up their reports per product and they lump all international markets together.

Acquisitions seem to be grouped and I found foreign exchange (forex). I’m struggling to understand where I would find volume and pricing.

Is it possible for this assignment to take some of the waterfall columns from the annual report and estimate the others based on research? Or if it’s mixed is it better to just estimate based on research to be more consistent throughout the assignment?

It’s a pity that McDonald’s doesn’t disclose volume figures. The current CEO once worked at P&G. Hopefully, investors would get more transparency in the future about the number of units sold.

Regarding Pricing, we could use the BigMac index as a proxy, but even if we do all that work, there is no transparency about other drivers. We could replace Acquisitions with “net number of stores”, but we would still be missing other drivers of growth.

Your best bet with the numbers provided may be to use the regional/or by type method instead. We have data for 3 regions and for 2 methods/type of business (company-owned and franchises)

I’ve downloaded all these numbers to Sales growth template v5 and added slide 7 to the deck. It looks like this (if you want to use it). Those files have been uploaded to resources so others can use them as well

5.About the waterfall

Watch a video I made with step by step instructions here:

https://nyu.zoom.us/rec/share/7E35KqB96pZrOQXtaZ9yAvsdYRb4dSWiSPKSR4_5Qp3G15es0hQrPuM05Gx9lcHh.YBksx0Syf0ET57j2?startTime=1601060959000

I have encountered a problem with my homework. Now I need to convert excel to waterfall in PPT, but when I copied the blue part of the data in excel and paste them to the waterfall template in PPT, I found that all the data became 0. I try it many times, but the waterfall can not formed. I’m not sure if there is a problem with my excel or my operation? I attached my Excel to the email. Please enlighten me further. Thank you very much.

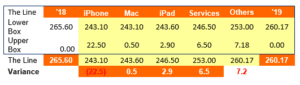

This is what your data looks like:

There are 3 reasons why you may be having trouble:

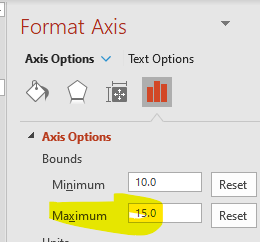

- The range of the axis

In your case, the sales range from $266 to $260, but the scale of the axis is set to 10-30

Please change the scale of the axis to a maximum of 300 To do this:

1.Stand on the axis

2.Right click on it

3.A format axis will appear in the right-hand side

4.Change the range to a maximum of 300, with an interval of 100

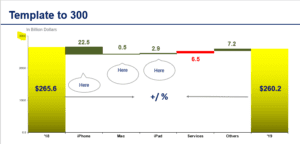

The chart will then look like this

Next, we need to change the order of the data

2. Order of the data

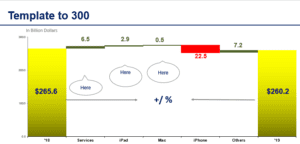

We need to list the changes in decreasing order for the colors to be automatically updated in proper order. This will also make it easier for the reader to see. Swap the order of Service and Iphone

Your chart will then be ready to use and it will look like this:

3.Not copying data as values

When you copy the data into the Powerpoint, make sure to copy it as value.

If this solves the problem, please let me know.

6. When I’m pasting my excel (orange & yellow table) results into the template in PowerPoint, the result returns zero every time and thus ruins the whole waterfall.

There are 3 reasons why you may be having trouble:

- The range of the axis

In your case, the sales range from $21 to $13, but the scale of the axis is set to 10-15

Please change the scale of the axis to a maximum of 25 and a minimum of 0. To do this:

1.Stand on the axis

2.Right click on it

3.A format axis will appear in the right-hand side

4.Change the range to a maximum of 25, with and a minimum of 0

Next, we need to change the order of the data

- Order of the data

We need to list the changes in decreasing order for the colors to be automatically updated in proper order. This will also make it easier for the reader to see.

Your chart will then look like this:

Finally, change the color for Media Networks and Studio to red (right-click on it and change data point) Then the chart will look like this:

3.Not copying as values

When you copy the data into the Powerpoint, make sure to copy it as value.

If this solves the problem, please let me know.

7.When transferring the data from the excel sheet to the waterfall template, the data seemed to transfer but two of the lines in the waterfall were not drawn (fragrance and haircare). Each of these categories had the number 0 but no line was drawn below or above it. However, I noticed with my “other” column, though it read as 0 when looking at the data on excel it actually was 0.02, so there is a line even though it still says 0.

I went ahead and changed the “upper box” number on both fragrance and haircare to 0.01 and now it shows a line. Is that incorrect to do? I just wasn’t sure of another way for there to be a line drawn to represent 0.

The reason why PowerPoint doesn’t draw a line is that the value is zero. These are the solutions

- The safest way would be to change the cell in the orange box to a number greater than zero (0.01 or higher). That way you leave the formulas unchanged.

- Yes, you can also do what you did

- The other way to do it is to manually draw a line. Too much work in my opinion.

Foreign Exchange

I watched YouTube videos about the Big Mac index. I felt like I understood something, but I am not sure what it means when we say that a currency is overvalued or undervalued.

Let me try with one example.

Imagine that since you were a kid, your parents always took you on holiday to Thailand. You always got yourself a Diet Coke at a kiosk (convenience store) when you got there. It was always about a dollar, the same price that in China. The Thai Bhat fluctuates; sometimes it was $0.95, sometimes $1.10, but always around $1.00.

One year, when you got there, it was $3. It should have been $1, but now it was $3. That is because the currency was overvalued. This can happen due to inflation.

Another year, you got there and it was $0.50. It should have been $1, but now it was $0.50. That is because the currency was undervalued. This can happen when there is a drastic depreciation or devaluation of the currency until prices adjust.

___________________

In the case of Thailand, with the BigMac index, when The Economist says that “the currency is 32.4% undervalued”, I don’t think that they are comparing with a different time.

You right. When The Economist says that “the currency is 32.4% undervalued,” they are not comparing to a different time.

They are comparing the price in Thailand, Costa Rica, or any other country with the price in the US. If it’s cheaper, they say that the difference is because the currency is undervalued. If it’s more expensive because the currency is overvalued. Let’s build on the example we have for Thailand to get closer to what the BigMac index tries to do.

Imagine that the regional price for a Coke is set at $1. Both in China and Thailand, it sells for $1.

When Diet Coke was selling for $0.50 instead of $1, it was because there was a pandemic in Thailand. There were no Chinese tourists. As a result, the Thai Bhat demand dropped, the currency weakened, and stores reduce the local prices to attract Chinese tourists.

Since Chinese entrepreneurs knew it was cheaper in Thailand, they went with their families on holiday to stock up on Diet Coke. They enjoyed the beach and brought back Diet Coke cases that they resold in China for $1.

By doing that, two things happened. When they converted dollars to get the Thai Baht, the exchange rate for the Thai currency strengthened. At the new exchange rate, the cost of Diet Coke rose to $0.80. Secondly, when they got to the stores to buy Diet Coke, there was so much demand that stores increased prices to $1. Thus, the price went back to $1, the same as in China. That, in essence, is what the BigMac index principle argues.

In the opposite direction, the same would happen when the price in Thailand was $3 instead of $1. Thai residents would travel to China to buy Diet Coke there, which costs $1 instead of $3. The Thai currency would weaken because all Thai residents would be selling Thai Baht to purchase dollars. And because there is no demand, local stores in Thailand would reduce prices to sell. As a result, the cost would move back to $1.

When I was a kid, I grew up in a border town where cross-border trade would happen all the time when there were exchange rate discrepancies. Small entrepreneurs would seek to arbitrage that.

According to the Big Mac index, at the actual exchange rate, a Big Mac in Costa Rica should cost 3473 colons. But now it only costs 2,350 colons. So a Big Mac in Costa Rica is cheaper than in the U.S. A YouTube video said, “if a burger in Costa Rica is cheaper, then colon is undervalued.” I was thinking, isn’t it good that a Big Mac is cheaper? I found it so confusing.

The Big Mac index is looking at it from the theoretical point of view of an economist. Based on this theory, a Big Mac anywhere in the world should cost the same price ($5.66).

More recently, The Economist has adjusted to account for the fact that people in the US make more money than in Costa Rica. The economic term for that is “adjusted on a GDP per capita basis”.

Let’s look first at what The Economist is doing:

Big Mac cost

Costa Rica $3.83

NY $5.66

$3.83 is 67.4% of 5.66, or 32.4% lower than $5.66. Therefore, The Economist suggests that the currency is 32.4% undervalued.

The Economist also realizes that such a statement is incorrect because people in Costa Rica make less money than in NY. When you click on the tab called “GDP adjusted”, you see that on that basis their currency is 11% overvalued (because people make 39% less money there).

Which one is correct? Is the currency 32% undervalued or 10.7% overvalued?

Price positioning

Neither one is correct, because we have to take into account other factors. In Costa Rica, we wouldn’t price a burger at the same price as in the US, due to the cost of local raw materials, real estate, competition, and most importantly, strategic price positioning.

Real estate cost: you may remember that in session one we looked at the price of real estate in Manhattan, and concluded that the most important cost driver for a cup of coffee at Starbucks was real estate. The same applies to McDonald’s in Manhattan.

Starbucks in China and McDonald’s in Hong Kong are interesting exceptions to the logic. Starbucks in China is more expensive than in NY, which doesn’t make sense from a GDP per capita or competition point of view. That is because Starbucks is positioned as a premium product.

McDonald’s is extremely inexpensive in Hong Kong, compared to India, which doesn’t make sense from a GDP per capita point of view. This is because it’s positioned at a strategic price for Hong Kong.

How can I explain to a friend from Costa Rica what the Big Mac index?

Tell your friend that the Big Mac index enables you to see that a Big Mac in Costa Rica is 32.4% cheaper than in the US ($3.83 vs $5.66), which is still expensive. It should cost 39% less.

In Seigel’s paradox, you can never know about future prices and thus people (consumers) can be pushed to trade their preferred goods/currency to non-preferred goods/other currency. Is this wise to do? Can we ever be certain about foreign exchange or is it always volatile? How do we mitigate this risk factor?

In the short term, we can not be certain about foreign exchange. It’s volatile and an educated guess at best. In the long term, the market tends to correct itself and adjust for differences in inflation.

To mitigate that risk factor, we can:

1. Buy insurance, also known as a hedge. The premium for the insurance is inexpensive for currencies like the dollar and the euro, and very expensive for the Brazilian real due again to the high inflationary rates.

2. Let the customer/consumer take the risk, and pass on the savings to them. That “insurance” or hedge has a cost. It may make sense to let the consumer decide.

Based on the data from the annual report for Pfizer, the sales of the company grew. With the ongoing pandemic and since Pfizer is a pharmaceutical company, we see an increase in the sales for many of their products since 2019. When comparing data for 2019 and 2020, products listed under the therapeutic area of oncology had the greatest growth and made up most of the sale. When looking at the data for 2019 and 2021, vaccines had the greatest growth and made up most of the sales. From 2020 to 2021, there was a huge increase in the sales growth for vaccines compared to other therapeutic areas. When looking at the product Eliquis, we can see that there was a 19% increase in sales growth in 2021 compared to 2020.

The concept of price positioning is rather intriguing to me. Many western chain stores position themselves as more of premium stores when they enter the Chinese market. For example, when Pizza Hut first came to China, people thought of it as a fancy restaurant since there were no other American pizza place. Pizza Hut’s price positioning strategy was understandable considering the historic context. Yet years later, when Aldi opened its first Chinese store in Shanghai a few years ago, it also chose more of a premium positioning. I wonder if it’s a sustainable strategy since China’s has seen so many international and gourmet supermarkets as of now. Big Chinese companies like Alibaba, also started premium grocery stores. In a financial perspective, is Aldi’s positioning wise? Or is it their initial strategy preparing for expanding in China with lower prices in the future?

Continued with the example of China, as Chinese myself, I’d like to share some of my observations of how important exchange rate is to China. Being the biggest exporting country, exchange rate matters to Chinese economy. As far as I’m concerned, a slight fluctuation would tremendously affect the profitability for some manufacturers whose major clients are from abroad. Particularly during the pandemic, some manufacturers could barely sustain only when the exchange rate is low enough for Chinese RMB to US dollar.

When Donald Trump called China manipulating the exchange rate, he clearly didn’t understand, or maybe he did, how important export is to China when there’s no profitable alternatives such as integrated circuit, chips for computers/smartphones, autos etc. That’s why the Chinese government has released a series of policy to help with the so-called “industry upgrading,” meaning instead of being the world factory that provides the world with daily essential items, China should upgrade for those high profit margin industries/products, like IT, Automobiles, stepper for chips and so on. This, inevitably, challenge the present players in the industry. For example, Huawei got banned by Donald Trump because they were leading the 5G technology and it would harm the interest of the 4G leader Telia Company for which American companies owned 11% of the share as the market size for 4G was around USD 121.80 billion in 2018.

In my opinion, price positioning should be determined by the following factors: pricing target, market demand and product cost. In order to expand market share, impact sales as the goal, should adopt low positioning. This method is generally suitable for the early stage of putting products on the shelves, or for new stores, which need to attract users in the fastest time and start to make profits as soon as possible. Leading with quality or mainly engaged in high-grade brand goods, it is recommended to use high price positioning. The price of such products is slightly lower than that of other platforms, but the price difference should not be too great, otherwise consumers will not trust. In order to avoid competition, it is advisable to adopt average price positioning. The degree of consumers to accept the price, market demand determines the upper limit of the price. If we price more than consumers can accept, consumers will not pay no matter how good our products are or how good our services are. You can refer to the method of target population consumption level in target population positioning. The cost of goods includes procurement cost (production cost of goods), employee salary, transportation cost and so on. The cost of a commodity determines the floor of the commodity price. If the commodity is priced below the cost, the merchant will lose money. However, when businesses and shops are in business difficulties, the price can be set below the cost, in order to quickly clear inventory, speed up the recovery of funds and recover costs.

Sales growth is certainly driven by many factors, but most importantly the product itself and the market demand. We live in a world where product popularity changes within a few days, going from one product’s high demand to another. Companies need to adapt to the fast paced environment to boost their product’s marketing for higher demand across different countries. After the pandemic, there was certainly a decrease in demand from many industries, and an increase in others, which resulted in new adaptations from a producer’s side to keep on attracting customers. The currency exchange is another big factor for sales growth: a weaker currency affects the imports as they are more expensive, but they stimulate exports as they make it cheaper for overseas. Regarding exporting , China is a big hub for manufacturing and exporting as they have many means to do so at a low price, which drives sales growth. Taking Coca Cola as an example, they have factories in almost all the countries they sell in, which removes the import and export factors, and increases the profit made on the sales.

I am interested in your example about the changes in the price of Diet Coke in Thailand because of the changes in market demand. I think your example here fits the idea of neoliberalism perspective of economics, which holds the view that factors like the globalization is resulting in an economy model based on more market and less government. In you example, the change in the price of Diet Coke is completely based on the supply-demand relations in the market. However, in reality, this may not be the case. Thailand and China are two different countries. In addition to the demand-supply relations, the price of the Diet Coke is also impacted by the trade policy of the two countries. For example, you mentioned that “since Chinese entrepreneurs knew it was cheaper in Thailand, they went with their families on holiday to stock up on Diet Coke. They enjoyed the beach and brought back Diet Coke cases that they resold in China for $1.” However, the is based on the assumption that the Chinese government does not impost any tax on this kind behavior of the Chinese entrepreneur. In addition, it seems that you also do not consider other costs for Chinese entrepreneurs, such as transportation costs.

Coca-Cola’s net sales increased 10% this year to $9.46 billion. Even though the company states that this quarter’s revenue was hurt by six fewer days than previous year, we can see the the rate of sales growth of Coca-Cola isn’t as strong as prior years. Coke earned 45 cents per share, which is higher than most people expected. This is in line with my previous analysis of their strategy to control cost. So their organic revenue still increased 9% in the quarter. I want to say that the driver of sales growth is their new product development but it does not seem to spike as much attention as expected. So it could be driven by the well developed supply chain and positive brand imagine built over the years.

The article above talked about foreign exchange. As a Chinese, I would like to share my views on the importance of foreign exchange for China. First, as an international means of payment, exchange provides payment and repayment for the purchase of strategic materials and key technologies for national economic construction and scientific and technological development. When a financial crisis or war comes and the international economic situation suddenly deteriorates, the country can effectively defuse and deal with unexpected financial risks and ensure orderly and stable financial order. Third, foreign exchange is the symbol of national wealth, national reserve assets, strong foreign exchange strength, on behalf of the country to conduct international affairs, the more economic support. It can not only win the right to speak for the country, but also bring huge economic benefits to domestic enterprises.

My overall idea for this assignment would be to focus on cost savings. I would propose setting the location in Turkey since their currency depreciates very much. “Turkey is in the throes of a currency crisis. The lira has lost more than 40 percent of its value against the United States dollar this year, making it the worst-performing of all emerging market currencies.” Also, it would be convenient for Europeans and Asians to travel to Turkey. It is kind of like the midpoint of the world.

My overall idea for this assignment would be to focus on cost savings. I would propose setting the location in Turkey since their currency depreciates very much. “Turkey is in the throes of a currency crisis. The lira has lost more than 40 percent of its value against the United States dollar this year, making it the worst-performing of all emerging market currencies.” Also, it would be convenient for Europeans and Asians to travel to Turkey. It is kind of like the midpoint of the world.

By comparing the depreciation of other currencies against the US dollar over the past three years, I think the venue should be moved to Turkey. The first reason is that the Turkish lira has been depreciating since February 2018, and its exchange rate has fallen sharply from 1 lira to $0.27 today to $0.054 today. By comparing the currency purchasing power of countries around the world in June, it can be known that the same commodity Turkey needs to spend the lowest price. For example, it only takes 0.43 US dollars to buy a can of Coke in Turkey, while the US is 0.8, Japan is 0.56, Argentina is 0.96, and the UK is 1.79. As a result, the cost of hosting a conference in Turkey will be significantly reduced. Second, Turkey’s geographic location straddles Asia and Europe. The number of executives in Asia and Europe accounted for 60% of all executives. This means travel to Turkey is convenient for executives in Europe and Asia and saves some money on airfare. The final reason is that 70% of the company’s executives are from outside Europe, so few of them may have traveled to Turkey. Company executives can take advantage of the conference to travel around Turkey to appreciate the local culture.

The company I picked is L’Oreal. 2021 is a historic year for L’Oreal. They have 16.1% growth increases. And twice the beauty market growth. It is a very strong increase in profits.

The sales growth compared to 2019 increased by 11.3%.

The earnings per share is an increase of 20.9%.

L‘Oreal has four divisions, and L’Oréal Luxe became the Group’s largest Division, with remarkable success in fragrances, while the Consumer Products Division, the largest Division by volume, strengthened its position, with noteworthy performance in makeup. The fast-growing Professional Products Division continued its far-reaching transformation and became truly omnichannel. With a portfolio of brands that perfectly matches consumers’ health aspirations, Active Cosmetics also achieved spectacular growth, doubling in four years.

The reason why L’Oreal can achieve such large growth is due to the strict cost control and comprehensive e-commerce support of the L’Oreal Group. Due to the epidemic, offline shopping has decreased sharply, but the new comprehensive e-commerce and marketing support makes L’Oreal Group stand out from the major cosmetics groups.

L’Oréal continues to innovate, update products and acquire new brands to make the group stronger. Four different divisions showed their magical powers to seize different consumer markets, and the profits of the entire group rose steadily.

Despite rising prices, it has not stopped the enthusiasm of consumers. L’Oreal is committed to bringing the latest and best products to those who love beauty.

For this sales growth assignment, the company we chose is Apple. By reading the annual report, I’ve notice that Apple is actually doing very well throughout the history. Even with the hit of global pandemic, Apple’s total annual net sale in 2020 still increased 6% compared to 2019, but the net sale on iPhone specifically was decreased by 3%. However, we cannot use the number in 2020 to represent how well a company was doing because it was impacted by COVID-19. Therefore, using the numbers in 2021 would be more realistic. In general, Apple increased roughly around 41% on their total net sales compared to 2019, which is very amazing. The main driver in this case will be iPhone because the net sales of iPhone increased 34%, and iPad was following right after it. Overall, Apple is doing very good on their sales, and I think that’s because they have very high brand loyalty which also builds brand trusts in populations. Moreover, they are almost release new products every year with their newest technologies, which I personally think it helped with the sales as well.

I would recommend moving to Europe to host the event. The suggestion is based on three factors, the dropping currency, local inflation and traveling expenditures.

Compared to other currencies, EUR/USD currency shows a dramatic decline of 13.6%. At the same time, considering the current executive distribution, 30% from the USA, 30% from Europe, 30% from Asia, adjustment to hosting in Europe would not affect the rise of airfare. Plus, compared to other countries, European countries like Spain and German are relatively stable and safe. Although inflation rose 9.9% YOY in Europe, the main price increase is in energy and food, which means event-related expenditure would not be greatly affected. Also, European countries like Spain and German have nice scenery and are good choices for vacation destinations.

I picked Disney fiscal 2019 compared to 2021. The total revenue decreased from 69.5 to 67.4 in Billions in the year 2021 (-2.1%). This revenue can divide into 4 major divers. The largest diver is Direct-to consumer which increased by 7% mainly from increasing the pricing rate at Hulu, Disney+, and ESPN+. The following factor is Media Network which increased from 24.8 to 28.1 billion (+3.3%) due to the increase in Cable advertising revenue. However, the studio entertainment factor decreased by 3.8%, and Disney parks, Experience and Product factor also declined from 26.2 to 16.6 billion. These impacted by Covid19 consequently close theme parks in many countries.

I recommend holding the meeting in Vienna, Austria. Vienna is located in the center of Europe and Vienna has many experiences holding international conferences. That would reduce some costs caused by the unprofessional and confusion among local undertakers. 30% of European & Middle East executives can travel to Austria quickly, which also reduces the time for North American executives to take the flights. For Asian executives, the time to Austria is similar to New York City. Some Asian executives could have a chance to come to Europe to discuss future cooperation since there are more and more connections between European and Asian markets. With the depreciation of Euros, the cost will be much lower. “The euro fell to a two-decade low of 0.9903 against the U.S. dollar and strategists predict further euro depreciation in the coming months.”, according to CNBC.

In order to save costs, I think this event should be held in Figure 2. The reason is that Turkey’s currency has depreciated the most relative to other currencies in the past three years. Therefore, exchanging US dollars for Turkish currency can obtain the maximum amount and achieve the result of reducing expenses. 1 Turkish lira is now equal to $0.054 and is the lowest depreciation of the Turkish lira in nearly five years. In addition, the current exchange rate between the euro and the US dollar is almost 1:1, so it is also a good choice to hold a conference in Europe. However, for air tickets, hotels, meals, entertainment prices in Europe and in Turkey, Turkey still has cheaper prices. Therefore, I think this meeting should be held in Turkey.

Background: Apple organizes an annual event for 100 executives. The budget is $1 Million for 3 days(This includes all traveling expenses, hotels, meals, and entertainment). It works out to $10,000 per executive. The executives come from 30% North America,30% Europe & Middle East,30% Asia, and 10% Oceania & Pacific. Some executives mentioned that we should take advantage of the currency’s depreciation in Europe, Japan, Turkey, Argentina, and other countries and hold the meeting there instead of in New York. We selected the largest city of the continents that the Executives are from: Europe: Istanbul, Turkey, Asia: Tokyo, Japan, Oceania/ Pacific: Sydney, Australia. For North America, New York City will be used since that’s where the meeting has been held before.

Latest Forex:1USD=150.46JPY, 1USD=28.16TRY, 1USD=1.59AUD

The average cost of food: New York is $348.34, Istanbul is $67.65, Tokyo is $145.35, and Sydney is $246.24.

The average hotel cost: New York is $555, Istanbul is $207, Tokyo is $348, and Sydney is $387.

The average cost of entertainment: New York is $213.76, Istanbul is $56.44, Tokyo is $75.56, and Sydney is $98.77.

The average cost of flights: New York is $ 1200, Istanbul is $300, Tokyo is $1300, and Sydney is $2100.

So, I recommend Istanbul because the total cost in 3 days is the cheapest, which is $631.09.

The total cost in different regions: North America is $69513.2, Europe is $18932.7, Asia is $56067.3, and Oceania/ Pacific is $28320.1.

So, the total cost of an annual event is $172833.1.

The currency exchange rate depends on variable factors, for example, interest of one currency may lead to major investment from foreign investors and drive up demand of which currency, or macro policy. It is not easy to predict the change of currency, the best approach of solve this problem would be entering a forward, future, option contracts to eliminate and minimize the risks comes with the change of currency. As the company agenda would be not to loss revenue due to fluctuation of exchange rate instead of speculation, it would be a feasible for company to determinate what is the exchange rate that they can accept and entering contracts with either counterparty or clearinghouse.

First of all, we need to analyze the depreciation of Europe, Japan, Turkey and Argentina relative to the US dollar in the past three years.

According to the inquiry, we can know that Turkey and Argentina have greatly depreciated against the US dollar. Therefore, from the point of view of currency depreciation, I suggest choosing Turkey and Argentina, because holding activities in these two countries will save more costs than other countries.

But at the same time, we should also consider other factors, such as safety. We need to ensure the safety of participants.

To sum up, my suggestion is to choose Turkey as the venue for the event.

Amazon’s net sales increased by more than 9% in 2022, from $469,822 in 2021 to $513,983 in 2022. The main sectors contributing to Amazon’s sales growth was its North American market and more importantly its Amazon Web Services (AWS). North American sales increased by 13% and AWS sales increased by as much as 29%.

From these data, we can devise strategies to sustain and further boost sales for these growing markets and find ways to increase sales for Amazon’s international market which was negative in sales growth.

First, to sustain sales growth in North America, Amazon can work to improve customer experience in app and online by improving UI and UX. More so, Amazon can push personalised recommendations and facilitate a faster checkout process to incentivise users to purchase.

Amazon is already seeing significant growth in AWS with its successful marketing campaigns and partnerships. Therefore, to maintain growth in this sector, Amazon can work on strengthening partnerships with tech companies such as Microsoft and Samsung to create joint ventures, strategic alliances, or even acquisitions to enhance its service offerings.

Finally, to boost sales for its international market, Amazon could expand its product range to collaborate with local vendors and artisans to sell niche products that would fit the local economy. For example, in Japan Amazon could partner with Lotte, one of the biggest snack companies locally to sell products oriented towards a Japanese audience.

Apple’s revenue in 2022 is US$394.3 billion, which is an increase of 8% compared with US$365.8 billion in the previous year.

Among them, iPhone is the main driver of Apple’s revenue growth, followed by service fees.

iPhone net sales increased during 2022 compared to 2021 due primarily to higher net sales from the Company’s new iPhone.

models released since the beginning of the fourth quarter of 2021. Services net sales increased during 2022 compared to 2021 due primarily to higher net sales from advertising, cloud services and the App Store.

Although iPad sales have decreased, the impact is not significant because it accounts for a small portion of Apple’s business.

n 2022, Spotify experienced significant sales growth, ending the year with a robust subscriber base of 205 million users. The company’s annual revenue reached an impressive 11.7 billion euros, reflecting a notable 21% increase from the previous year. This substantial growth underscores Spotify’s strong position in the competitive digital music streaming industry. Despite the challenges and changes in the landscape, Spotify managed to adapt and thrive, emphasizing the company’s ability to navigate evolving market dynamics while maintaining substantial sales growth.

Unilever reported a sales revenue of $6,341.2 million in 2022, marking a 13.72% increase compared to the previous year. For Unilever, the impact of prices on its sales growth is significant. Since 2022, in response to the persistent inflationary environment, Unilever has implemented an overall price increase of 11.3%. This has led to price-led growth as a driving factor for the company at present. In the future, as inflation begins to abate, Unilever aims to gradually stabilize prices and explore alternative growth strategies.

First, Unilever can leverage its stable partnerships, including collaborations with retailers and online sales platforms, to continuously optimize its product distribution channels. Simultaneously, Unilever can actively expand into emerging business sectors such as sustainable products and healthy lifestyle offerings to cater to a broader range of consumer needs.

Additionally, Unilever’s key markets include North America and China. To further stimulate international market sales growth, Unilever can promote the localization of its brand in overseas markets. Collaborating with local suppliers and tailoring products to suit the preferences of different countries and regions will enhance market share. Active participation in social responsibility and sustainable development initiatives will also help boost brand image and increase market presence in international markets.

In summary, Unilever’s priority is to gradually reduce its dependence on price-led growth and seek diversification in its growth opportunities. This approach will not only enable the company to navigate the challenges of inflation but also ensure sustainable and robust growth in the future.

For the Disney’s Media and Entertainment Distribution(DMED) segment, It generate $4,174 million dollars more in 2022 than that of 2021, with the growth rate at 8.2%. The drivers of this growth including increase in Linear Network, Direct-to-Customer and Content Sales/ licensing and Other (Three business line under this segment). Higher contractual rates and Higher advertising revenue led to an growth in revenue of Linear Network (about $253m increase). The $3,239m increase in revenue from Direct-to-Customer’s primarily due to the increase in subscription fees. The rise in Content Sales/Licensing and Other ($800m) is the result of the higher theatrical distribution revenue.

For the Disney’s Disney Parks, Experiences and Products (DPEP) segment. The Revenue increased from $16,552m in 2021 to $28,705m in 2022 at 73%, which is a large increase. The most critical factor lies in the Theme Park Admissions and this business line’s increase ($4,754m) due to the higher attendance growth and higher average per capita ticket revenue. The growth in Parks & Experiences merchandise, food and beverage ($3,280m), was the result of higher consumer spending and the higher occupied hotel rooms led to the increase in Resorts and Vacations business line, which accounts for $3,709m. Besides, higher sponsorship revenues and Increased royalties resulted in $422m increase in Parks licensing and others business line. But because of the Retail stores’ closer, there was a $12m decrease in Merchandise licensing and retail business line.