- This event has passed.

Reinforcement Learning and the Discovery of Arbitrage Opportunities

March 20, 2019 @ 6:00 pm - 7:00 pm UTC+0

You and your colleagues are invited to attend the Cornell – Citi Financial Data Science Seminars at the Tata Innovation Center at Cornell Tech, 5th Floor Conference Room. Through the talks this semester, we are excited to collaborate with Citi in highlighting machine learning applications in finance.

All seminars are from 6:00pm to 7:00pm. This seminar will not be recorded due to room limitations.

Seminars are free. However, registration is required for NYC attendees as seating is limited (RSVP here).

Date: Wednesday, March 20, 2019

Time: 6:00pm – 7:00pm

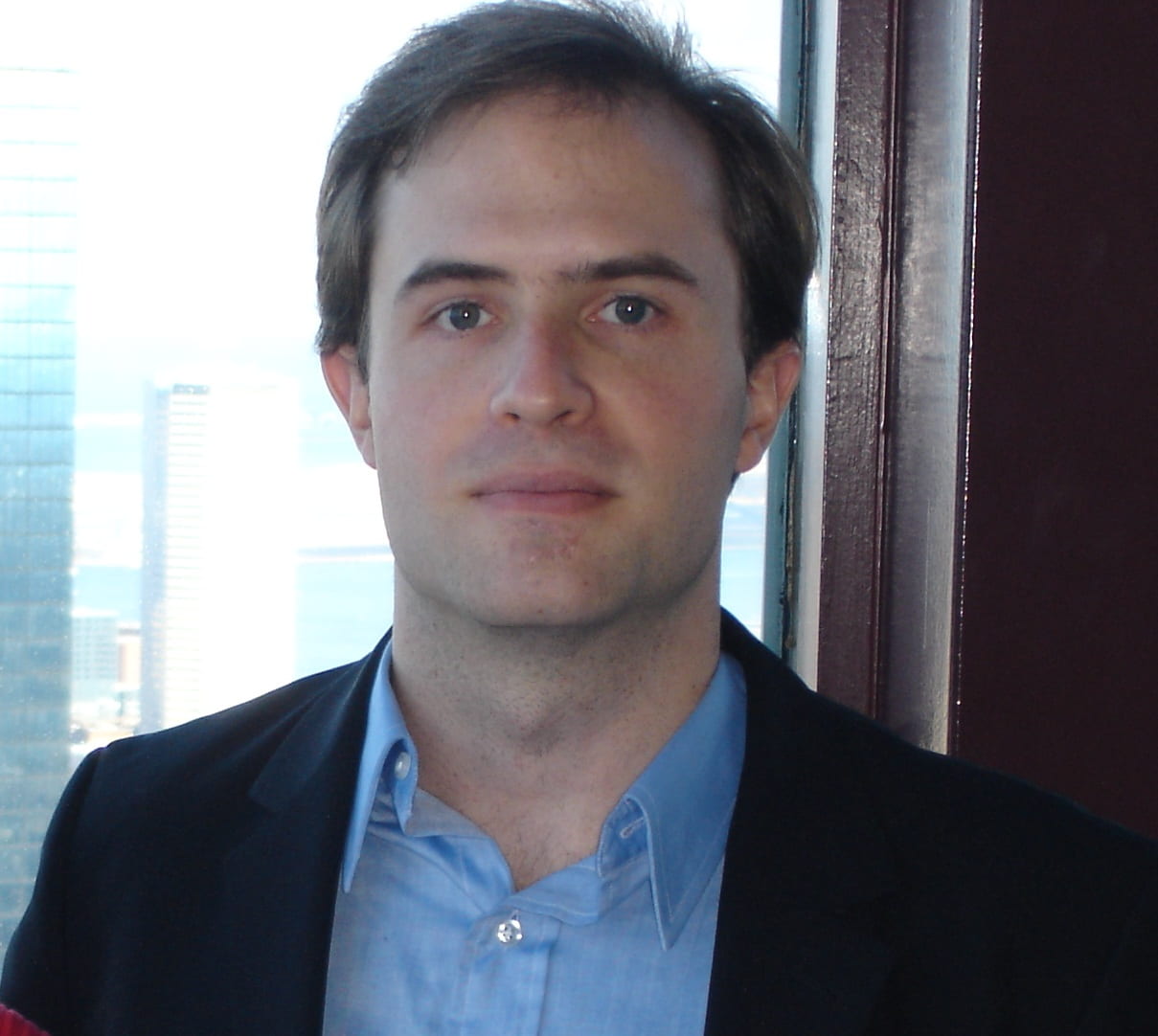

Speaker: Gordon Ritter | NYU Courant & Tandon

Title: “Reinforcement Learning and the Discovery of Arbitrage Opportunities”

Info: Reinforcement learning is a way of training a machine to find an optimal policy for a stochastic optimal control system, without explicitly building a model for the system. In reinforcement learning, the search for optimal policies is organized around the search for the optimal value function (in the sense of the Hamilton-Jacobi-Bellman equation). We show that many problems in finance are special cases of this framework; for example, any derivative that can be priced by replication has the property that its price is given by the value function of the dynamic replicating portfolio strategy. Optimal execution problems — such as the Almgren–Chriss model and its extensions, are also problems of this type, and reinforcement learning techniques can be used to train agents which are capable of executing, or hedging, optimally. This remains true in the presence of market impact, and is insensitive to the type of market impact model that is used.

Bio: Gordon Ritter is a Professor at NYU Courant and Tandon, Baruch College, and Rutgers, and an elite buy-side quantitative trader / portfolio manager (selected as Buy-Side Quant of the Year, 2019). His scholarly research papers have 10,000+ downloads; he is an expert in statistical machine learning and its applications in finance. Most recently Gordon was a senior portfolio manager at GSA Capital where he designed, built, and managed statistical arbitrage strategies in multiple geographies and asset classes, and directed research in GSA’s New York office. (GSA won the Equity Market Neutral & Quantitative Strategies category at the Eurohedge awards four times, with numerous other awards.) Prior to GSA, Gordon was a Vice President of Highbridge Capital and a core member of the firm’s statistical arbitrage group. Gordon is frequently an invited speaker and typically speaks at 20+ conferences per year. Prior to entering the hedge fund industry in 2007, Gordon completed his PhD in mathematical physics at Harvard University, where he worked with Arthur Jaffe and published papers in international journals across the fields of quantum computation, quantum field theory, and abstract algebra. He earned his Bachelor’s degree with honours in Mathematics from the University of Chicago.

We hope to see you there!

The Cornell-Citi Team

Directions to CFEM&Citi @CornellTech on Roosevelt Island: Take the Tram or the F train to Roosevelt Island; walk to the left along the East River until you see a glass, modern-looking building, which is the Tata Innovation Center. Take the elevator to the 5th floor, and the conference room will be on your right.