On April 18, 2024, Meta released their AI assistant that was built by Llama 3 on their family apps including Instagram, Facebook, Messenger, and WhatsApp. According to Meta, Meta AI is “now the most intelligent AI assistant you can use for free.” Users can now use Meta AI in feeds, chats, search, and more, directly in its family of apps without leaving the app itself, which makes it more convenient for the user to “get things done.”

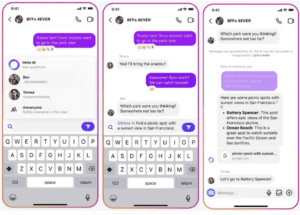

Meta AI’s capabilities on Instagram include assisting users with various tasks as seen in the image below. Users can simply @MetaAI, followed by their request. Once the request is sent in messages, Meta AI generates a response directly in the chat, visible to all users in the conversation.

According to The Verge, the Meta AI assistant is the only chatbot that integrates real-time search results from both Bing and Google, meaning Meta’s algorithm determines which search engine to use based on the nature of the query, ensuring comprehensive and accurate responses to user prompts.

Another notable feature of Meta AI is its image generation capability. Unlike other AI image generators that may have limited usage or require premium subscriptions, Meta AI offers free and fast image generation. With Meta AI’s Imagine feature, users can create images and GIFs from text in real-time. This feature is currently in beta and rolling out on WhatsApp and the Meta AI web experience in the US.

Meta AI also prioritizes user privacy by requesting specific information instead of automatically accessing account data. Unlike other chatbots that users can enable or disable, Meta AI is permanently integrated into Meta’s apps. Initially, there were reports of confusion regarding its disablement, but Meta clarified that the chatbot cannot be removed.

With the recent release of Llama 3 and Meta AI, it is more clear what path Mark Zuckerberg wants to go down. Rather than solely emphasizing the established social aspects of their apps, he’s prioritizing expansion and concentrating on the Reality Labs sector. By integrating AI elements into social media, Zuckerberg aims to offer users a new experience, providing Meta with a competitive advantage in the market.