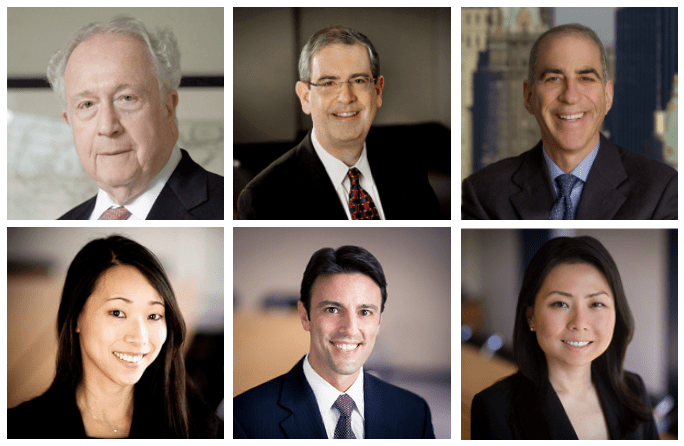

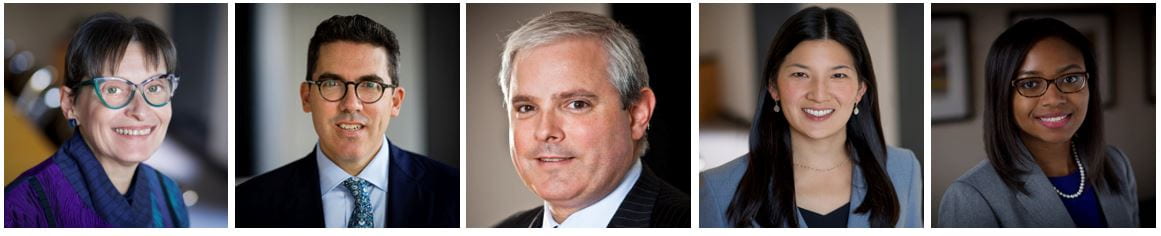

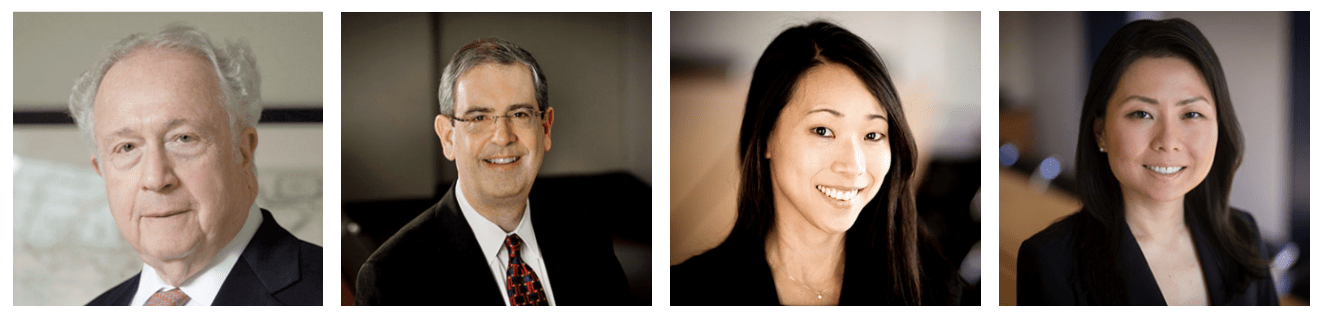

by Charu Chandrasekhar, Avi Gesser, Kristin Snyder, Julie M. Riewe, Marc Ponchione, Matt Kelly, Sheena Paul, Mengyi Xu, and Ned Terrace

Top left to right: Charu Chandrasekhar, Avi Gesser, Kristin Snyder, Julie M. Riewe, and Marc Ponchione.

Bottom left to right: Matt Kelly, Sheena Paul, Mengyi Xu, and Ned Terrace. (Photos courtesy of Debevoise & Plimpton LLP)

Registered investment advisers (“RIAs”) have swiftly embraced AI for investment strategy, market research, portfolio management, trading, risk management, and operations. In response to the exploding use of AI across the securities markets, Chair Gensler of the Securities and Exchange Commission (“SEC”) has declared that he plans to prioritize securities fraud in connection with AI disclosures and warned market participants against “AI washing.” Chair Gensler’s statements reflect the SEC’s sharpening scrutiny of AI usage by registrants. The SEC’s Division of Examinations included AI as one of its 2024 examination priorities, and also launched a widespread AI sweep of RIAs focused on AI in connection with advertising, disclosures, investment decisions, and marketing. The SEC previously charged an RIA in connection with misleading Form ADV Part 2A disclosures regarding the risks associated with its use of an AI-based trading tool.