Co-authored by Professor Scott Robinson and Graduate Student Sabya Das

Major transit developments, particularly commuter rail hubs that serve as nodes for multiple lines of connection, have historically been a key driver to real estate development in the surrounding market. The need for these critical mass transportation facilities is higher than ever as we emerge from the Pandemic and evolve into a complex digitally-centric economy.

Despite the critical importance of these transit hubs, many are in urgent need of redevelopment. Basic structural upgrades, climate resiliency, capacity expansion, and technological enhancements are complex and expensive. Cost estimates are difficult to calculate because of the diverse array of ownership structures across jurisdictions and market segmentation, but even conservative estimates are in the trillions. The Biden Administration recently proposed a $2T infrastructure plan which allocates close to $160B to public transportation and railways.

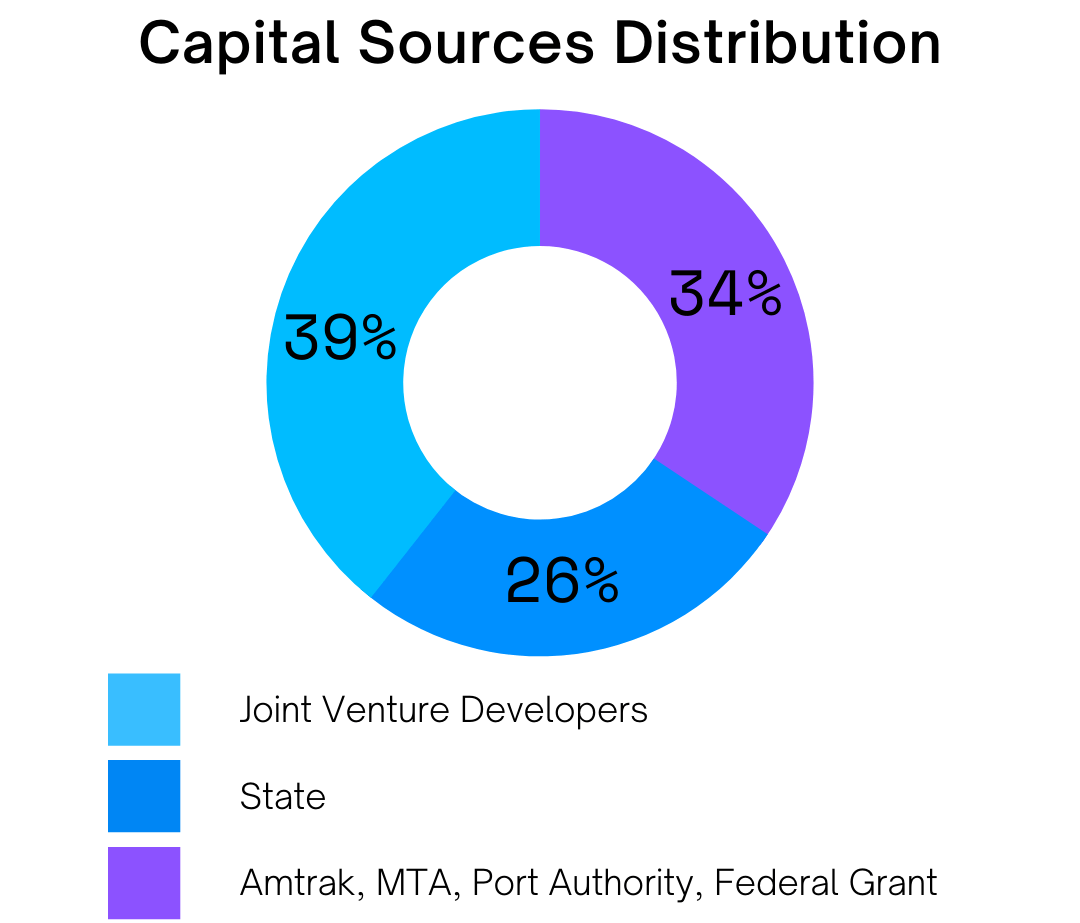

This funding gap makes it apparent that public sector funding, while clearly important, simply won’t come close to covering the full scope of needs. Given the intersectional economic role of transport hubs, creative funding solutions utilizing multiple sources of capital must be crafted. Public investment clearly serves as a catalyst for private investment into the more traditional real estate, as well as the projects in the surrounding neighborhoods. This combination of diverse sources of capital is referred to as Public Private Partnerships (“PPP”). Typical sources of private capital for transit-oriented development include traditional infrastructure funds and REITs.

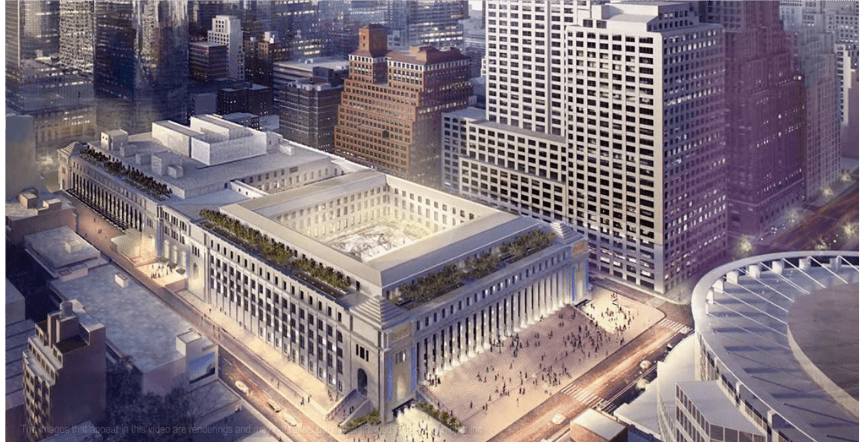

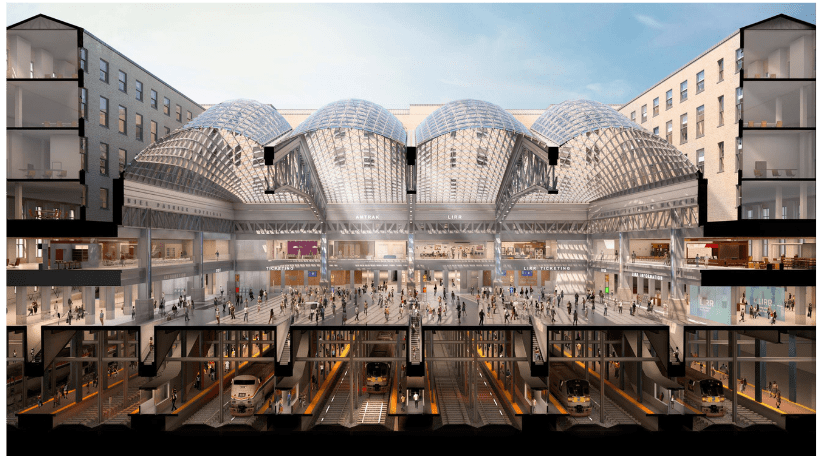

There are a few high-profile transit hub projects that serve as a model for future PPP strategies, proving the value of the intersection between infrastructure finance, public finance, and REITs. The referenced panel explores one such model transit-oriented development: the Farley Building at Penn Station.

The Farley Building redevelopment at Penn Station includes the adaptive reuse of the landmark post office building. The project includes a new 255,000sqft Moynihan Train Hall to provide passenger facilities for the Long Island Railroad and Amtrak. The total 1.3M GSF redevelopment post-historic restoration and addition have created a state-of-the-art transportation hub with commercial and quality civic space.

Watch the webinar on Transit Oriented Development: The Intersection of REITs + Infrastructure

Moderated by Professor Scott Robinson

Panelists:

Sabyasachi Das, Graduate Student Moderator, Schack Institute

Ray Albright, Managing Director, Keel Harbour Capital

Alan Reagan, Vice President, Development, Vornado Realty Trust