Executive Summary

The COVID-19 pandemic presents a worldwide challenge to battle issues in our professional work, food systems, and public health. During these unprecedented times, our economy and society continues to suffer. Amidst the turbulence, our world encounters yet another fight: climate change. Unless in the next 10 years global greenhouse gas emissions cut in half and global warming increases to a maximum of 1.5°C, scientists acknowledge irreversible damage, such as extreme poverty + heat and major drought + flooding. Additionally, we must reach net zero emissions prior to 2050. Candidly, the entire economy must recreate itself as a sustainable entity. At large, sectors including energy, agriculture, transportation, materials & resources, and the built environment play a pivotal role. In preparation for the challenges which lie ahead, climate tech will act as the necessary driving force to adopt and innovate the global economy. Although the total dollars into climate tech appears insufficient, investment into the industry over the last seven years continues to grow. In particular, the built environment, the greatest industry contributing to climate change, is bound to receive far greater dollars of venture funding. A major headwind the built environment faces is the industry’s lackluster effort to adopt innovation. Nonetheless, trends driving sustainability, such as greater demand from stakeholders and shareholders, favorable capital markets and pressure from governments, will continue to accelerate the investment and adoption of climate tech initiatives. The market presents an opportunity for investors to enrich innovators with the capital required to produce a significant difference in the world and generate monumental returns.

Climate Tech Investing

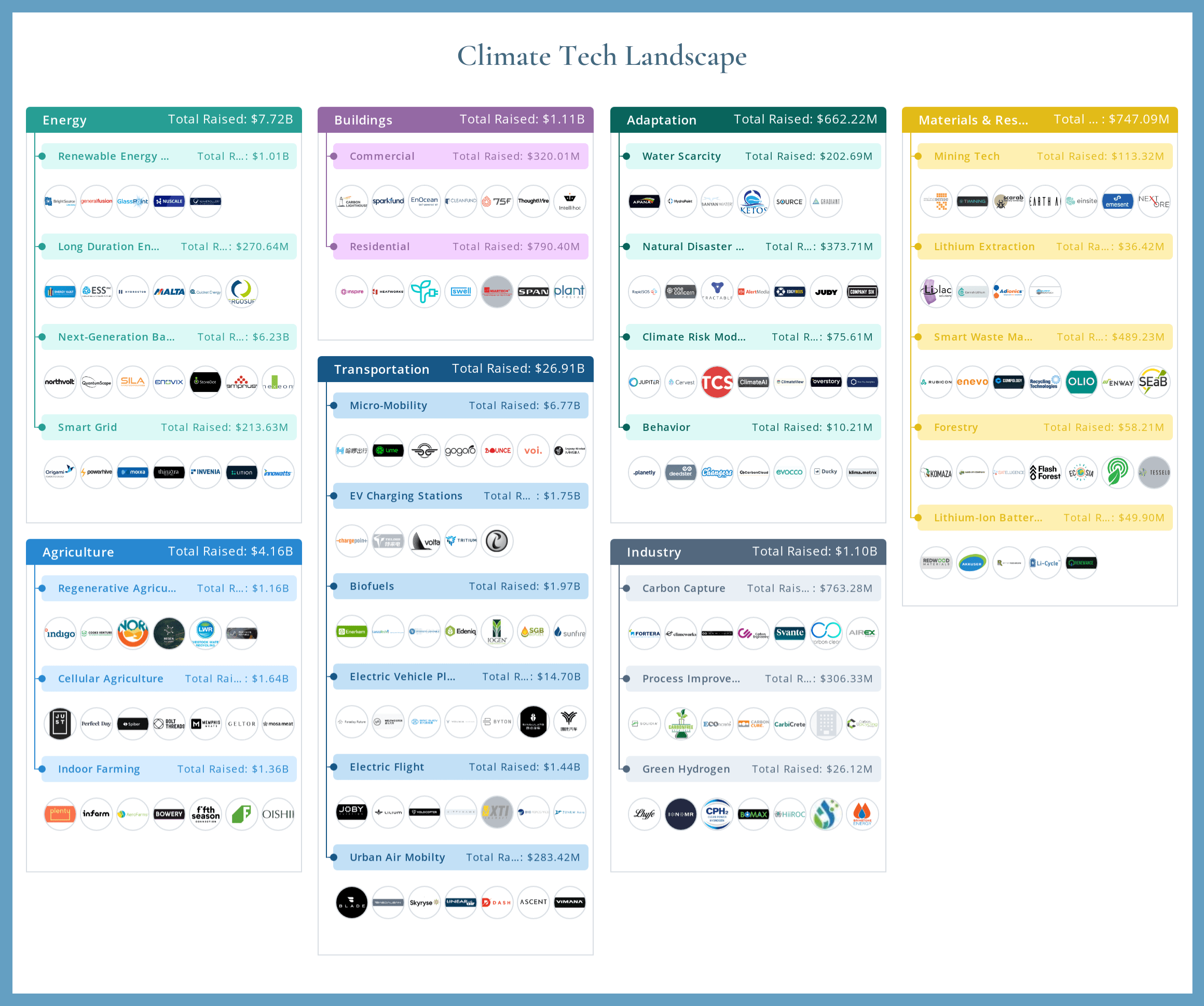

Consisting of a large group of industries tackling the decarbonization of our earth’s economy, climate tech is the investment sector dedicated to achieving net zero emissions prior to 2050. Notable sectors within climate tech encompasses energy, agriculture, buildings, transportation, adaptation, industry and materials & resources. This overview will specifically touch on the ‘Built Environment’ and target the discussion towards buildings and construction.

Climate Tech Investment Opportunity

The human race is tasked with its greatest battle by decarbonizing our economic activities. Simply put, time is running out. The world is challenged to limit global warming to 1.5 °C by 2030; a battle which will require drastic action. By no means, should this draw investors to close the door into the space. While the solutions required to achieve this goal must be met quickly and effectively, already the climate tech bug is reaching local to national governments, small to large businesses, and shareholders + stakeholders around the globe. Additional trends driving investment and investor interest in the space consist of recent technology advancements, greater sustainable demand by consumers and corporates, political and regulatory commitments, and boosted investments in climate tech.

Overview of the Built Environment

Just close to 40% of the greenhouse gas emissions (GHG) entering the environment come from buildings and construction. Over a third of GHG emissions generated from building and construction is associated with embodied carbon emissions. Embodied carbon is the sum of all the GHG emissions resulting from the mining, harvesting, processing, manufacturing, transportation and installation of building materials. Close to 2/3 of the emissions mentioned draw from operations which encompasses all activities related to the use of the buildings, over their lifespans. In order to minimize the GHG emissions originated by the built environment, a building and the life cycle of one ought to integrate effective processes and solutions. Innovation in energy used to heat, cool and light buildings includes, but is not limited to, air purification, electrification, carbon capture, zero-carbon hydrogen, and passive solar and radiant heating. Additionally, processes to consider adopting on the embodied carbon side consist of material-efficient design, reductions in material waste, substituting low-carbon for high-carbon materials, and circular economy interventions.

Analysis

Investment level: From 2013 to 2019, the built environment noticed just over 6% or $3.7 billion of the total venture capital dollars invested into climate tech. Given the extent the built environment is responsible for climate issues, a disproportionality small investment from climate tech is in effect.

Deal flow: In 2019, the built environment noticed 65 climate tech investments which is 5x more compared to 2013. Smart management and sensor technology raked in close to a third of the deals in 2019 primarily because of greater demand for this product, better understanding from investors, and low investment cost.

Investors: From a total dollars invested standard, Khosla Ventures, Obvious Ventures, and DFJ Growth rank the highest. Amazon Alexa Fund, Demeter, New Enterprise Associates, and Prelude Ventures lead investors for most deals invested in.

Performance Levers

Carbon Cutting Construction Systems

Themes in investments: over a third of the total built environment climate tech funding comes from here. Katerra, consisting of 90% of total investment dollars in the section, creates a lopsided investment story. The construction behemoth and a limited set of startups collectively sum up the group of companies aiding to control construction environments and waste reduction. Systems in place consist of modular construction, 3-D printing, off-site construction, and enabled construction planning.

Notable startups: Raising $1.2 billion from 2016 to date, Katerra is the most funded startup in this section. Additional startups worth mentioning include Plant Prefab, Factory OS, and NODE.

Sensor Systems

Themes in investments: Carrying a sum of 139 deals in relation to just over a quarter of the total investment dollars, the focal point of a sensor system is to save/reduce energy consumption costs in residential/commercial buildings. Systems in place consist of energy consumption analysis, site condition monitoring, equipment/material/facility management, and data gathering sensors.

Notable startups: From a relevance and venture capital total funding standpoint, companies in this vertical creating noise include Veev, a home operating system platform, EquipmentShare, a startup providing construction workers smart jobsite technology, and Prescient, an integrated design, engineering, manufacturing, and construction solution platform.

Final Thoughts

While the current capital, time, and energy spent towards the climate tech landscape is insufficient to achieve net zero emissions before 2050, over the course of seven years, the space noticed significant positive growth. As the largest proponent to GHG emissions by sector, the built environment is in a particularly special position to initiate positive change in the environment all while benefiting the bottom line in a scalable fashion. With the environmental crisis only likely to worsen this year, climate tech investing is likely to continue building momentum. Through trends such as growing advancements in technology, developing demand for sustainable initiatives by consumers and producers, local to national government backing, and increased capital allocation towards climate tech, the sector is well positioned to flourish.

About the author: Joshua is a graduate student at NYU SPS Schack Institute of Real Estate and Proptech & Innovation Committee Chair. As an aspiring built environment professional, Joshua is pursuing a Master’s in Real Estate. Influenced by constructing an innovative and sustainable built environment, he is determined to create a positive impact in the industry.