The opening event at the REITworks 2021 Conference was the Economic & Real Estate Market Outlook presentation by Jacques Gordon. The presentation provided a comprehensive look into the current economy by examining key drivers of real estate investment.

Jacques Gordon first covered how both monetary policy and fiscal policy are in flux with the Fed deciding whether to raise rates to combat inflation and Congress voting on the massive spending bills. He agreed with the general consensus of economists that the current spike in inflation is transitory and that the root issues are spot price commodities such as lumber and microchips. Looking past food and energy, consumer prices have been holding steady. Nevertheless, he expects a tapering of quantitative easing soon as interest rates cannot stay this low forever.

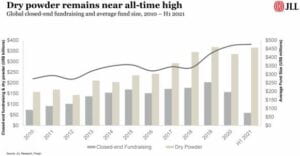

Next, he touched on the record amounts of dry powder in the market that private equity firms are having trouble placing in the market. Much of this can be attributed to an influx of funds made from tremendous returns on stocks in recent years. As interest rates remain low and stocks reach all-time highs, more investors are looking at investing in income-earning assets such as real estate. As such, the debt markets have been liquid and banks have been willing to lend at increasingly lower rates and higher leverage.

This year, the real estate capital markets have returned to the record levels from 2019 but the markets have also been entirely reshaped since then. Real estate investment is now more broadly diversified across alternative property types such as data centers, cell towers, and self-storage. What has not changed is that the US remains the largest real estate market in the world because of the size of its economy and diversity of real estate investments. Much of this can be attributed to the US companies who have been at the forefront of developing specialized real estate markets in the single-family rental, life science, student housing, and senior housing sectors.

Altogether, investment in US real estate is projected to continue its strong rally. Equity REITs (27% gain YTD)have significantly outperformed the S&P 500 (17% gain YTD), overcoming much of the disparity created by the pandemic in 2020. However, investors must pay close attention to the fiscal and monetary policies, which will have a profound impact on the fund flows of real estate investment.

The full presentation from REITworks can be found

here.

Leave a Reply